Welcome to our new collection, The Circuit. Meet our subsequent interviewee:

KPMG’s world Rising Giants programme helps fast-growth and scaling companies, working throughout a wide range of sectors to offer assist to corporations navigating the complicated, and infrequently overwhelming, early phases.

On this unique interview with UKTN, Lowe explains what makes the last word Rising Big, the particular qualities that founding groups have to progress past the early phases and the present investing panorama.

What key indicators or traits do you search for when figuring out a enterprise with the potential to scale efficiently?

There are a number of indicators we search for, and these change over time. We have to be sure that we perceive a product and discover how the product suits inside its chosen market. We all the time take a look at how we will pique an viewers’s curiosity, not simply domestically however on a world scale.

From an accounting perspective, we’ve a workforce that enhances early-stage companies. We contemplate the monetary mannequin, which is significant to find out how a product might be commercialised. We work with companies to create a monetary plan that outlines how their enterprise will create sustainable, recurring year-on-year income development so buyers are clear on the trail to profitability.

“We’ve a workforce that enhances early-stage companies”

Quick-growth companies typically face issue scaling. What are the commonest challenges you see startups encounter, and the way do you proactively assist them overcome these hurdles?

Our workforce operates throughout the UK, and a common problem we encounter when working with scaling corporations is entry to finance.

We work instantly with founders on their funding pathway both by means of our Entry programme – an investor readiness initiative – or working with them on a one-to-one foundation. We offer steering for companies to organize for a collection funding spherical; understanding the necessities a enterprise capitalist might be in search of and the conversations they need to be having.

Entry to new markets is one other key problem. KPMG is clearly a world agency, so we’re joyful to work with our colleagues world wide to construct connections, however we additionally work with companies to grasp what worldwide enlargement may imply for them.

With the companies you’re employed with throughout their most crucial part, how do you advise that they keep financially sound with out slowing their momentum?

Throughout this part, companies are sometimes shifting from MVP (minimal viable product) to scale, which requires each ahead planning and adaptability. Founders could also be specialists of their area of interest, however by this level they should shift their focus towards broader enterprise areas, particularly financials.

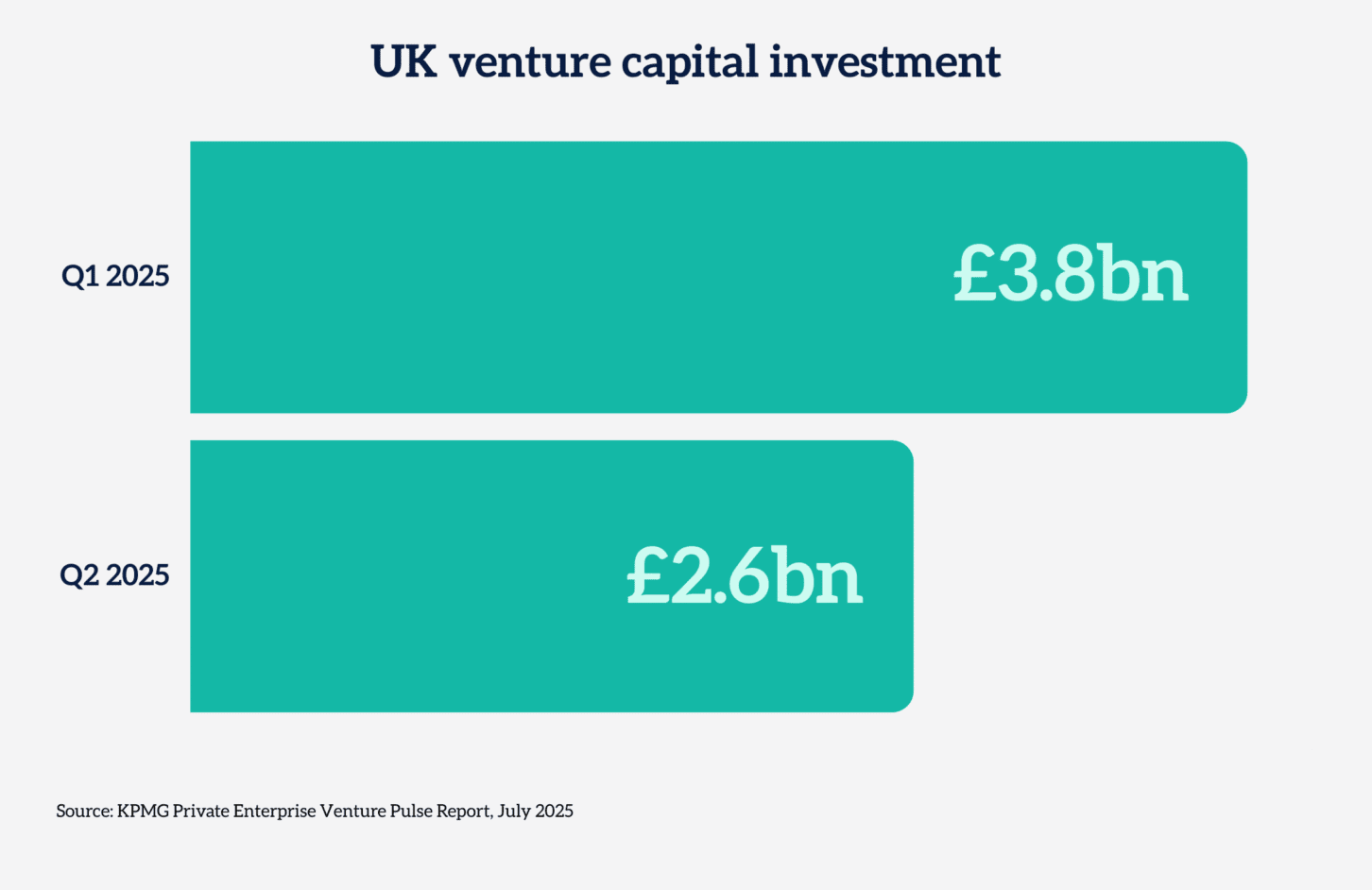

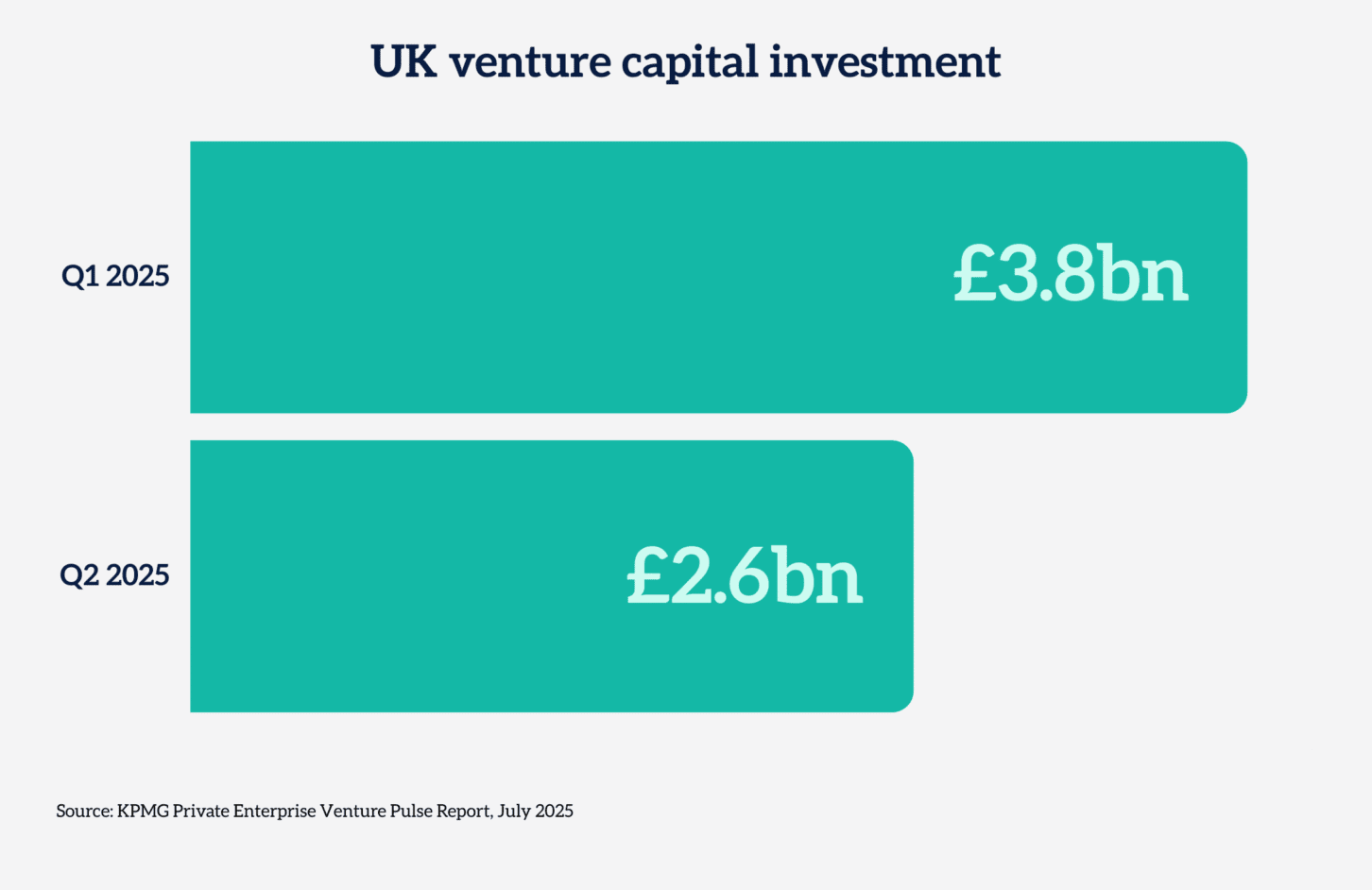

Being real looking is essential – significantly round timelines and funding. With VC funding not too long ago hitting a five-year low, founders should contemplate whether or not to pursue funding now or delay. Funding timelines are additionally extending; the place a Sequence A used to take four- to 6 months, it’s now extra like six to 12 and this must be a key consideration for companies embarking on their scaling journey.

To take care of momentum, it is very important assess gaps within the workforce. This may occasionally imply hiring extra skilled folks exterior the founding group to personal particular areas, permitting founders to concentrate on the place they add probably the most worth throughout a pivotal time.

The profitable method

Yearly, we maintain our KPMG’s 2025 International Tech Innovator competitors to seek out probably the most progressive and thrilling companies in numerous areas.

From its humble beginnings 12 years in the past, when chosen corporations would pitch over pizza and beer, it has since grown to grow to be a extremely regarded initiative that pulls a whole lot of functions yearly.

For the UK competitors, we had eight heats the place round 80 of the companies that utilized pitched in entrance of an impartial judging panel for every area. This panel consisted of an investor, an entrepreneur and somebody who’s both a pacesetter inside an area ecosystem or a part of a college incubator programme. This panel then chosen the finalists.

This 12 months, we had eight finalists who pitched in entrance of an esteemed panel of enterprise capitalists. We introduced everybody collectively for a celebratory dinner to announce the winner – Rachel Curtis at fintech enterprise Inicio.ai (pictured).

As a part of our Circuit interview collection, we communicate to execs from a number of the most fun corporations on the UK tech scene. These interviews supply perception about an organization’s journey, the sector during which it operates and the folks behind the job titles.

Go to The Circuit web page to learn all interviews within the collection and keep tuned for future conversations.