Help CleanTechnica’s work by way of a Substack subscription or on Stripe.

China is the Queen of EVs. That a lot we all know for sure. The benefit that Chinese language automakers have — rightfully — gained over their opponents is not going to be a simple one to beat. And but, to take the autumn of the centennial vehicle industries of North America, Europe, and non-Chinese language East Asia without any consideration feels to me like leaping the gun, even when the Chinese language menace is not like something these industries have ever confronted earlier than.

(Discover that I write “Car Industries” as an alternative of “Legacy Auto” as a result of the a part of the trade that may stay could effectively not be Legacy Auto, however incumbent native gamers. This I discover notably doubtless in North America.)

One of many perks of residing in a growing nation is that I get to see firsthand the battle between the established gamers and the incumbent Chinese language manufacturers with out the distortions attributable to both the hyper-competitive Chinese language market (with many manufacturers promoting at a loss) or the tariff partitions constructed to guard the native trade in North America and the EU. And since 2022, the inevitable conclusion has been that the Chinese language don’t have any peer within the EV sector … however that competitors may, finally, come up.

A 12 months in the past, I used to be targeted on North America. The US underneath Biden had been aggressively selling native battery manufacturing in addition to built-in provide chains within the larger North American area, making it a really stable manufacturing hub with entry to ample assets, low cost vitality, and the prowess of Mexico’s trade, which, not like the USA’s, can rent expertise at a value even decrease than their Chinese language competitors. Again then, I wrote {that a} window of alternative may very well be opening for GM, because the lately introduced Equinox EV was probably the most reasonably priced car in Latin America with a battery over 80 kWh. However I additionally stated this:

After all, there are lots of methods this will likely fail.

[…]

It might be that political will in the direction of EVs cools within the US and GM pauses its ramp-up, dropping this small window of alternative to change into aggressive with the Chinese language manufacturers.

Lo and behold, because of President Trump, battery manufacturing within the US is now not booming, vitality is getting rather more costly, and the massive, stunning provide chains by way of North America have been damaged, maybe irreversibly. Mexico will attempt to compete by itself, and maybe will even succeed, however these days, most attention-grabbing issues are taking place on the opposite aspect of the Atlantic.

The wave of reasonably priced EVs touchdown on Europe

A 12 months in the past, my optimism was restricted to at least one firm (GM) and one mannequin (the Equinox EV). However in Europe, because of that pesky interference of the EU and its draconian emissions requirements, the upcoming competitors shouldn’t be restricted to at least one firm, a lot much less one mannequin.

It was the Renault Twingo E-Tech that made me take into consideration this matter. In accordance with Latin American media, it is going to boast a 40 kWh battery and have a value of “underneath €20,000” (taxes included) which — translating into native foreign money — means underneath R$124.000 in Brazil and COP$90’000.000 in Colombia. And guess what? Should you had been to buy a 38 kWh BYD Seagull in Brazil or Colombia, it might value R$119.000 and COP$85’000.000, respectively. Which means, if imported in Latin America on the identical costs because it’s bought in Europe, the Twingo E-Tech can be a really robust competitor towards the BYD Seagull. And simply as vital, this mannequin was allegedly developed in solely two years, which isn’t removed from the hyper-quick growth that characterizes Chinese language manufacturers.

There are others. At lower than €25,000, the upcoming Skoda Epiq may face the marginally bigger BYD Yuan Up (€24,500), whereas the Fiat Grande Panda (apparently bought at round €23,000) may effectively face the BYD Dolphin at roughly the identical value. I may maintain happening, nevertheless it needs to be clear that even Stellantis (sure, that Stellantis) appears to be a succesful competitor right here.

And one thing I’m but to report on, however that additionally compounds right here, is that the Chevrolet Spark EUV has been a large success, reaching the highest 5 on its first month in Brazil, Uruguay, and Colombia, and turning into the best-selling EV within the (admittedly minuscule) Argentinian market. The Spark EUV stands roughly on the value of the BYD Dolphin, but stays costlier than comparable opponents such because the Geely Geometry E or the JAC E30X. Its success proves that individuals right here need EVs and are keen to pay a small premium to get one from the manufacturers they know and love as an alternative of getting to decide on a completely new (and unknown) one. This, even when the EV in query is in-built China, as is the case of the Spark EUV (which is a rebranded Baojun Yep Plus).

So, there’s no purpose why the Spark EUV’s success couldn’t be replicated by the Twingo E-Tech or the Skoda Epiq, solely this time being a European made EV.

Past optimism, a dose of actuality.

Europe’s EV trade standing is sort of promising, in case you ask me, however please don’t take me as saying Europe has caught up with China. Categorically, it has not.

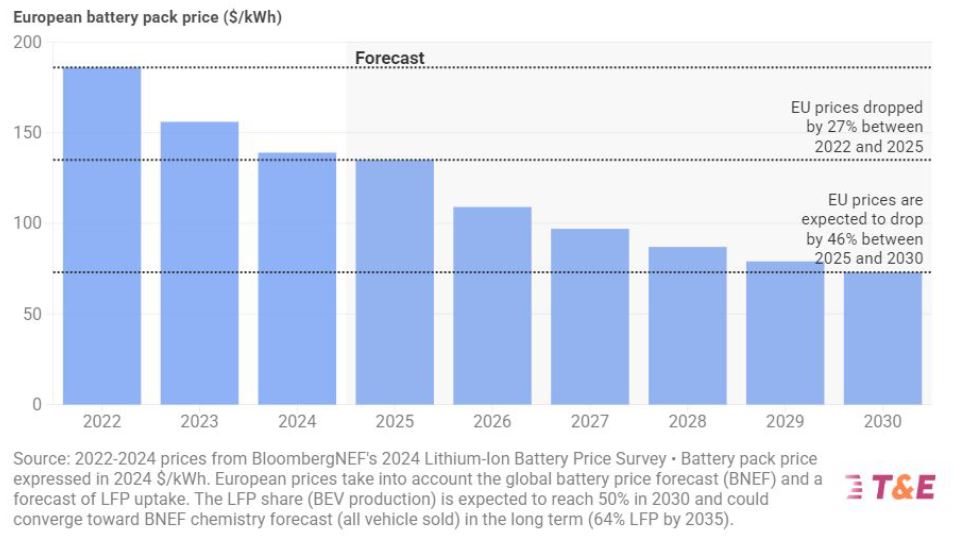

Chinese language EV makers depend on probably the most environment friendly battery provide chain the world has ever seen, with costs as little as $50/kWh this 12 months (although, more likely to be barely larger on common). In accordance with a latest report by Transport & Surroundings, Europe’s battery costs this 12 months stand at nearly thrice that quantity, and by 2030 will solely attain $75/kWh, which means lets say Europe is now 5 years behind China relating to battery prices, and maybe even extra relating to supplies provide chains.

China has additionally entered a state of hyper-competition that the EU will merely not enable, which means that it’s doubtless innovating quicker and that pricing within the native market is much under export markets, so ought to the necessity come up, they will simply minimize costs abroad. This additionally implies that even when the nominal value is identical, the Chinese language’s margin is larger, and European manufacturers may very well be incentivized to extract the final penny out of their ICEV fashions as an alternative of coming into with much less worthwhile EVs, even when meaning ceding the electrical market to the Chinese language. , make a pleasant revenue now even when the enterprise mannequin goes down the drain in a number of years, and all that.

Eventually, low cost vitality stays a crucial enter for industrial success, and Europe’s state of affairs, although a lot improved since 2021, remains to be precarious. The area has considerably freed itself from Russian gasoline dependency, however the fee has been vital, and the huge deployment of renewables (plus nuclear, if maybe France can pull it off as soon as once more) required to forego the pricey LNG has not totally materialized but. Europe requires an enormous quantity of storage, of high-voltage traces to cut back curtailment, and of latest photo voltaic and wind farms if it desires to get vitality costs to a degree the place it could actually meaningfully compete with China. However even right here, it appears that evidently Southern Europe, because of ample solar and large photo voltaic deployment, has been in a position to maintain vitality costs underneath management, thus offering an industrial base not as affected by excessive prices.

I don’t count on 2026 to be a 12 months of robust competitors from European manufacturers, as they nonetheless must ramp up and enhance gross sales in native markets to abide by the EU’s emissions requirements. However by 2027, they need to be able to bringing not less than a combat to our shores, lest they find yourself ceding all initiative to the Chinese language. Alternatively, they may depend on native manufacturing (because the Chinese language are doing in Brazil) whereas importing batteries from China or buying native batteries from Chinese language corporations, one thing that ought to enable them to beat one among their most vital hurdles.

(I, for one, would love to see Renault’s plant in Colombia churning out reasonably priced EVs).

What I do know is that European automakers, traditionally reliant on exports and gross sales in international markets, can’t afford to lose these to the Chinese language, so that they higher begin placing up some competitors. But, it appears, there’s nonetheless hope.

Join CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and excessive stage summaries, join our day by day publication, and observe us on Google Information!

Have a tip for CleanTechnica? Need to promote? Need to recommend a visitor for our CleanTech Discuss podcast? Contact us right here.

Join our day by day publication for 15 new cleantech tales a day. Or join our weekly one on high tales of the week if day by day is simply too frequent.

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage