After consecutive declines in August and September, confidence amongst manufacturing CEOs has rebounded in October, supported by sturdy order backlogs and renewed enterprise growth. On the identical time, leaders proceed to report the organizational drag of geopolitical and macroeconomic volatility.

Based on Chief Govt’s newest CEO Confidence Index survey, performed October 7 and eight, manufacturing CEOs price present enterprise circumstances a 5.6 out of 10, on a scale the place 1 is Poor and 10 is Wonderful. Up 24 % from final month’s poor ranking of 4.5, that is the closest producers have been to recuperating the March 2025 nosedive in present confidence.

When taking a look at what they forecast over the following twelve months, producers predict enhancing circumstances, forecasting an increase to five.9 out of 10 by this time subsequent 12 months—simply shy of the 6.0 ranking offered by non-manufacturers. That is the second-most-optimistic prediction offered for the reason that plummet, dwarfed solely by July’s 6.3/10 forecast.

Many producers attribute this newfound confidence to expanded backlogs and continued shopper demand. The CEO of a mid-size industrial manufacturing agency reported “the backlog … offers us [the] highest ever stage of enterprise by way of early 2027 … Our spare components and consumable providers for the techniques and instruments we’ve got at consumer websites are … persevering with to develop in North America.”

Others echo this sentiment: Randy Sadler, CEO of connectivity and automation merchandise producer Weidmuller, mentioned his 8/10 forecast of future circumstances is motivated by “knowledge middle development” and different enterprise growth initiatives.

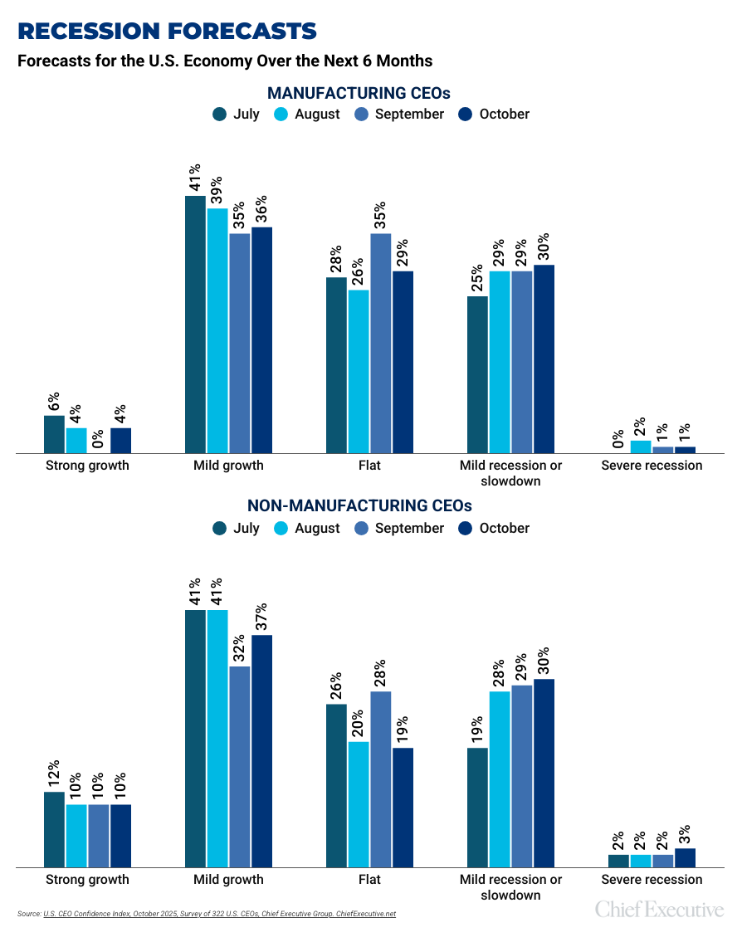

According to this boosted sentiment, respondents have develop into extra optimistic that the economic system will expertise both sturdy or gentle development over the following six months—4 and 36 %, respectively. Nonetheless, they proceed to stay much less optimistic than their non-manufacturing friends at giant.

Regardless of these enhancements, a powerful minority—30 % of producers—nonetheless forecast a gentle recession or slowdown.

A lot of this will likely need to do with sector-specific elements putting sure forms of producers at an obstacle. Mark Rutledge, President and CEO of laboratory gear producer World Precision Devices, stories that there’s “weak demand in life sciences resulting from decreased analysis funding.”

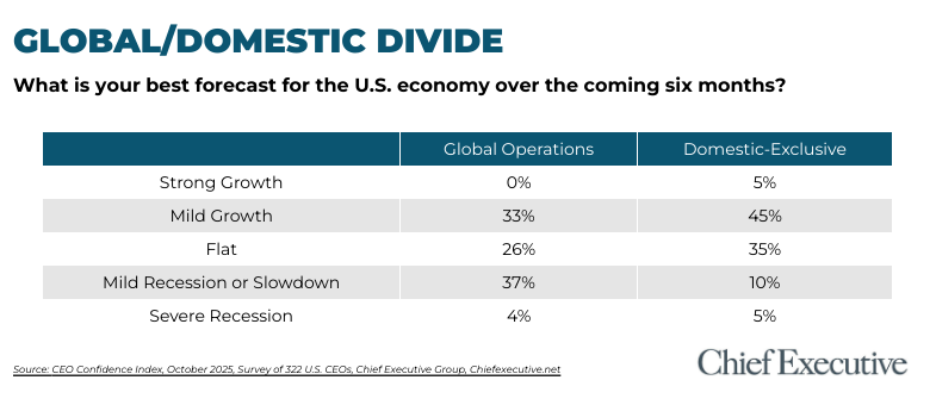

The vast majority of this optimism can once more be attributed to home producers, as a comparative evaluation exhibits that 37 % of respondents with world operations certainly predict a gentle recession within the coming months. In contrast with simply 10 % of domestic-exclusive producers, this disparity is telling.

Based on Matt Shieman, President of Aerospace Composites Options, a agency with operations in Europe, Asia and Canada, “prospects [are] not committing to giant orders” resulting from “a number of uncertainty available in the market immediately concerning the U.S. economic system and world commerce.”

Different world producers echoed this sentiment, citing tariff stressors and “gloomy unemployment.”

THE YEAR AHEAD

Yr forward forecasts are probably the most optimistic they’ve been in months, displaying sturdy development after a interval of regular decline.

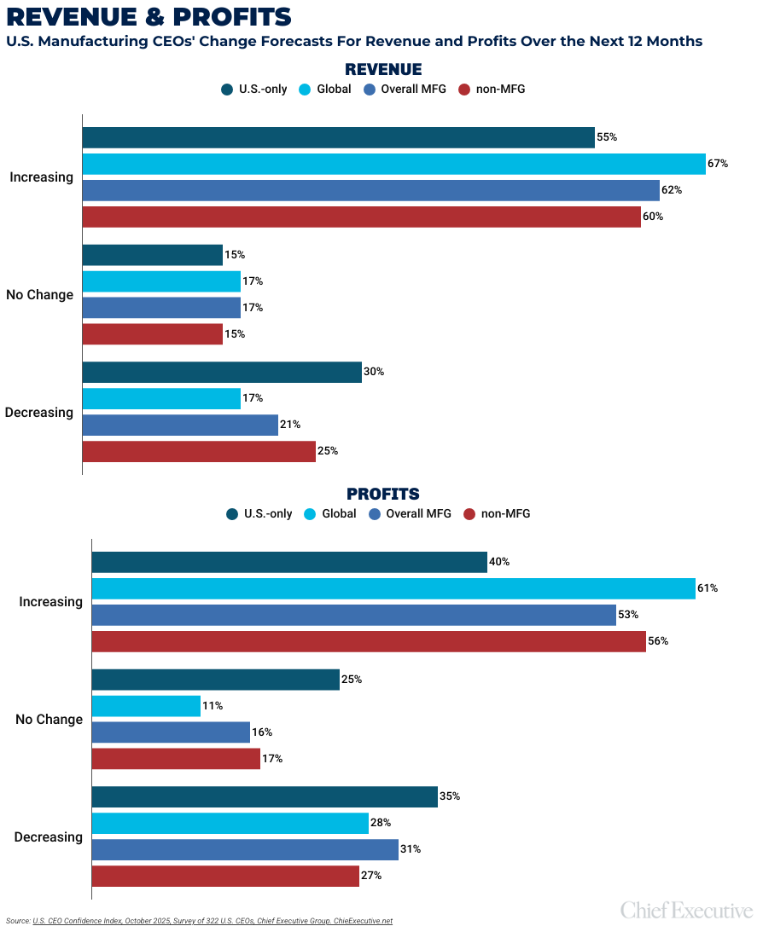

- 53 % of producers count on to extend their income within the 12 months forward, up 4 % since final month.

- 62 % of respondents forecast an increase in revenues over the following 12 months, up 3 % since September.

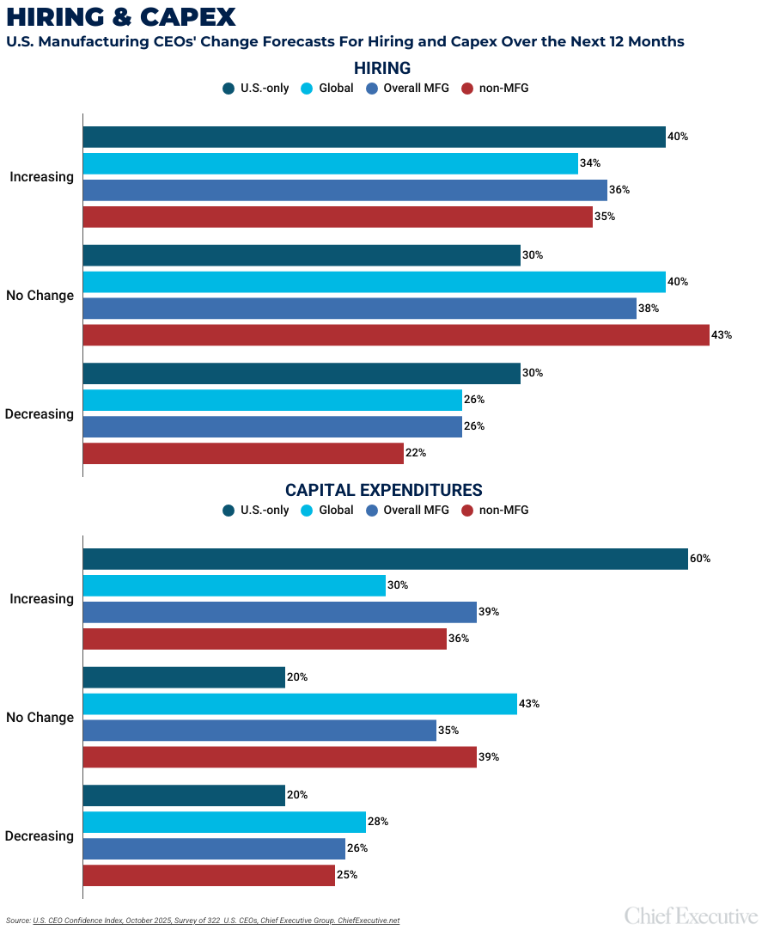

- 39 % count on to deploy extra capital over the following 12 months—a rise of three %.

- Hiring is up 38 % since final month—36 % of respondents now count on so as to add to their headcount by this time subsequent 12 months.

Of specific notice this month is the rise of worldwide producers who count on will increase to revenues and income over the following 12 months, which was steadily beneath the proportion of domestic-exclusive CEOs for months. That is ironic, contemplating the elevated stressors they face by being concerned in worldwide commerce networks.

Concerning the CEO Confidence Index

Since 2002, Chief Govt Group has been polling tons of of U.S. CEOs at organizations of all kinds and sizes, to compile our CEO Confidence Index knowledge. The Index tracks confidence in present and future enterprise environments, primarily based on CEOs’ observations of assorted financial and enterprise parts. For extra details about the Index and prior months knowledge, go to ChiefExecutive.web/class/CEO-Confidence-Index/