The world’s prime buyers as soon as once more confirmed their hand. 13-F reviews, which element what shares buyers managing greater than $100 million are shopping for and promoting, got here out, and revealed some thrilling traits.

Whereas 13-F reviews mustn’t function an in depth roadmap, they will provide some inspiration and meals for thought. However remember the fact that the reviews are delayed, and these buyers’ methods could differ from yours. However with that in thoughts, let’s dive into what the gurus have been shopping for and promoting these days.

The Huge Buffett Shock

“The Oracle of Omaha” wants no introduction. As a worth investor, he seeks out basically sturdy firms with a aggressive benefit which might be buying and selling under their intrinsic worth. So why did he purchase Google?

That’s proper! Warren Buffett’s Berkshire Hathaway took the headlines by storm, after revealing a large place in guess what. Google! Sure, the well-known worth investor has taken a $4.3 billion stake in Google father or mother Alphabet in Q3, making it the tenth largest holding.

Warren Buffett’s High 10 Holdings, supply: GuruFocus.com

Shopping for a tech inventory at an ATH? Not very Buffett-like. So what does he see in it? Effectively, Google is prone to be one of many winners of the AI revolution. Is Buffett getting in on the commerce? I’ll depart that as much as you.

One vital reminder is that truly, Buffett doesn’t management the portfolio a lot anymore. It’s his disciples, Ted and Todd, which might be accountable for it.

Nevertheless fascinating the stake in Google is likely to be, it pales compared to the $382 BILLION he’s holding in money. Up from $344 billion final quarter. To boost that capital, he continued promoting Apple and Financial institution of America. It’s one other report for Berkshire, and together with many different worth buyers, they in all probability don’t see that many low cost firms available on the market.

The worth of Berkshire’s inventory portfolio is $267 billion, however remember the fact that there are particular positions they don’t need to report, and that Berkshire’s portfolio is the various companies it operates, not simply the shares.

Nevertheless, Berkshire now presents an fascinating diversification alternative, with a lot money and lots of conservative companies below its hood.

Try Warren Buffett’s portfolio on eToro!

Michael Burry Shuts Down His Fund

Actually. The bearish investor, identified for predicting the 2008 actual property bubble and recession, gave up. At the very least that’s what it seems like. However it was a complete sequence of occasions, so let’s break it down.

Burry is commonly utilizing complicated methods involving shorting and choices to make giant bets on markets. He was not very profitable over the previous few years. Most not too long ago, he guess towards Nvidia and Palantir by shopping for bearish put choices. That led to some panic available in the market, however it will definitely subsided.

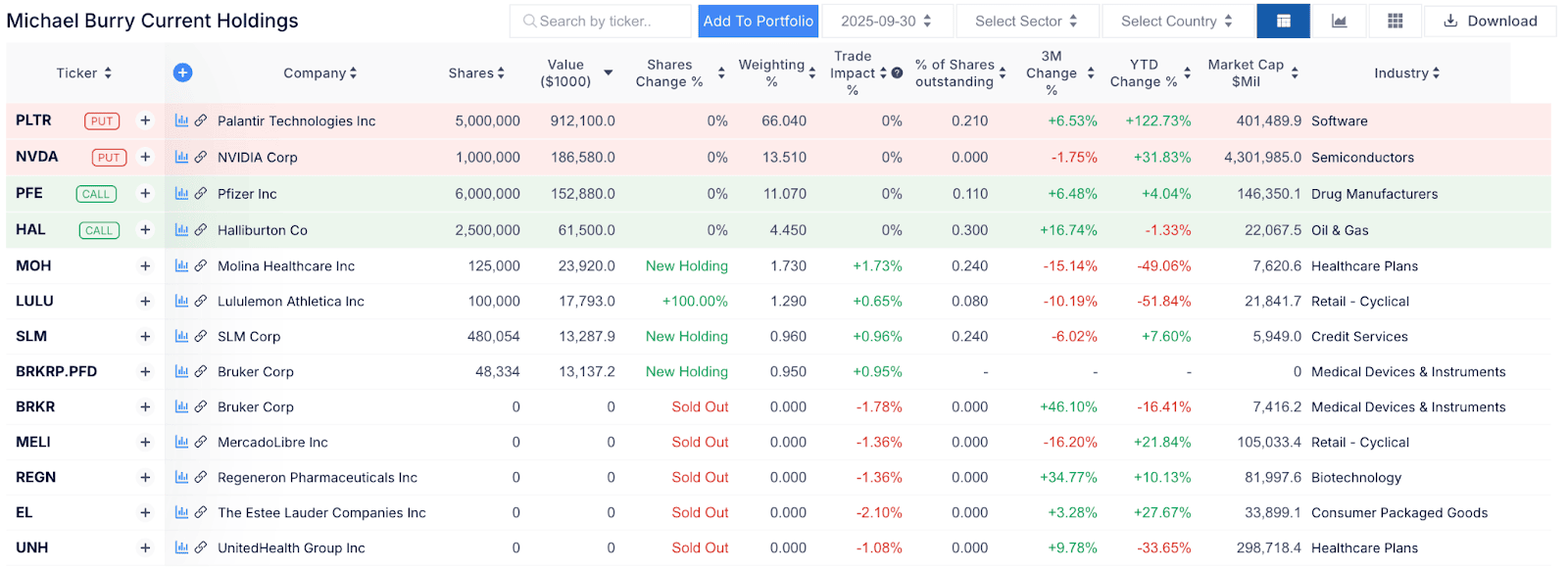

Michael Burry’s High 10 Holdings, supply: GuruFocus.com

Then, out of nowhere, he closed his fund, posting a letter that mentioned: “My estimation of worth in securities isn’t now, and has not been for a while, in sync with the markets.” Ouch. However he continues to commerce along with his personal capital. His newest portfolio strikes present that he bought all of his earlier holdings and acquired Lululemon, Molina Healthcare, SLM and Bruker.

Do you know that he launched his personal weblog? Yeah, Michael Burry now has a Substack. And properly, he almost broke the platform. Go test it out in order for you.

David Tepper Makes Strikes In Tech

Tepper is the billionaire founding father of Appaloosa Administration, a hedge fund identified for its aggressive funding fashion. His technique combines deep basic evaluation with a macroeconomic method. He typically makes daring bets on sectors or firms that different buyers keep away from. This makes him one of the revered buyers on Wall Road.

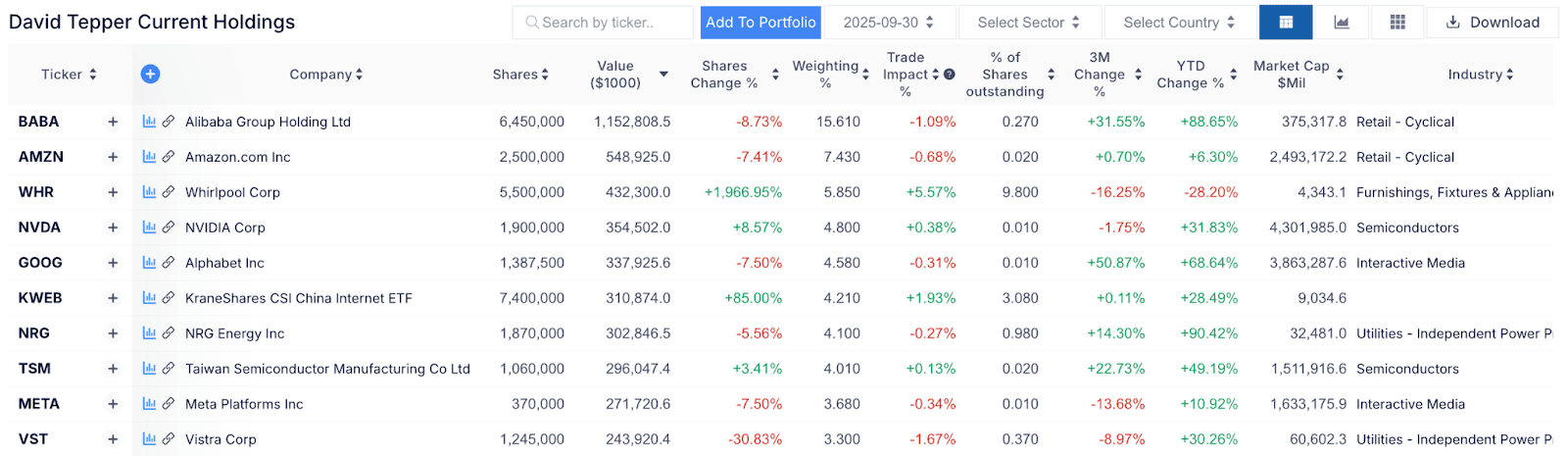

David Tepper’s High 10 Holdings, supply: GuruFocus.com

In Q3, Tepper continued investing in his AI conviction, albeit a bit slower than earlier than. He added to his positions in Nvidia, TSMC, Qualcomm and china’s Baidu, however he continued to scale back the opposite Huge Tech names, people who had been the topic of some criticism from Michael Burry over the previous weeks, such a Google, Amazon, Meta and Microsoft, however he additionally diminished different AI bets, corresponding to Alibaba and infrastructure supplier Vistra.

David Tepper has lengthy been bullish on AI, however it appears that he’s being extra restrained. In any case, AI shares have been on a wild trip this yr, so you possibly can’t blame him for some revenue taking.

What do you suppose? Are you continue to including to your AI investments? Let me know by tagging me as @thedividendfund on eToro!

Ray Dalio’s Bets on Broad Development

Ray Dalio is the founding father of Bridgewater Associates, one of many largest hedge funds on this planet and based on Fortune Journal, one of the vital firms on this planet! He employs a macro-focused, risk-balanced technique. He’s a giant believer in diversification and his views on world financial traits are extremely revered. I extremely suggest his three books, but in addition his LinkedIn e-newsletter!

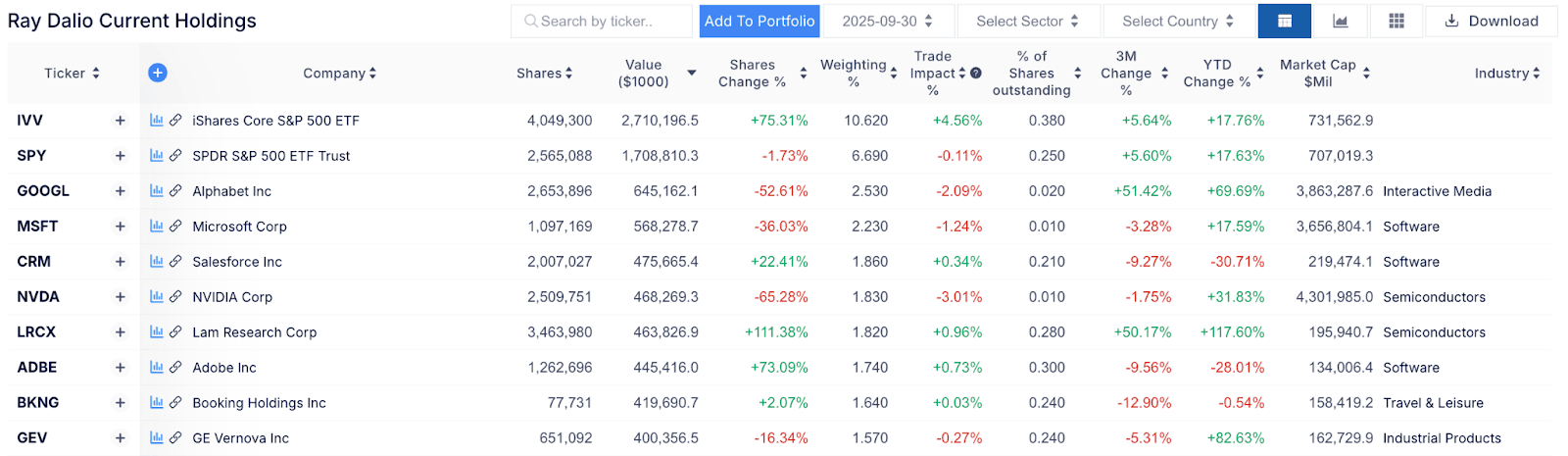

Ray Dalio’s High 10 Holdings, supply: GuruFocus.com

Dalio’s portfolio is fabricated from 1015 shares. Don’t get scared, these are break up throughout many funds. However there have been some very fascinating modifications. Dalio continues to be lowering large tech, promoting Google, Microsoft, Nvidia and Meta, however curiously including to distressed software program large Adobe.

He additionally saved rising his Salesforce holdings and massively elevated his stake in ASML. On the subject of the AI revolution, he’s primarily promoting the purchasers whereas shopping for the suppliers. What do you suppose he sees within the worth of the availability chain? Or is it simply portfolio rebalancing? That may be a secret he’ll sadly get to maintain.

Invoice Ackman Is Holding Regular

Invoice Ackman is thought for overtly stating his views and opinions and never being scared to place a variety of his cash the place his mouth is. He often buys a major stake in firms to attempt to sway them in a special route, hopefully enhancing shareholder worth.

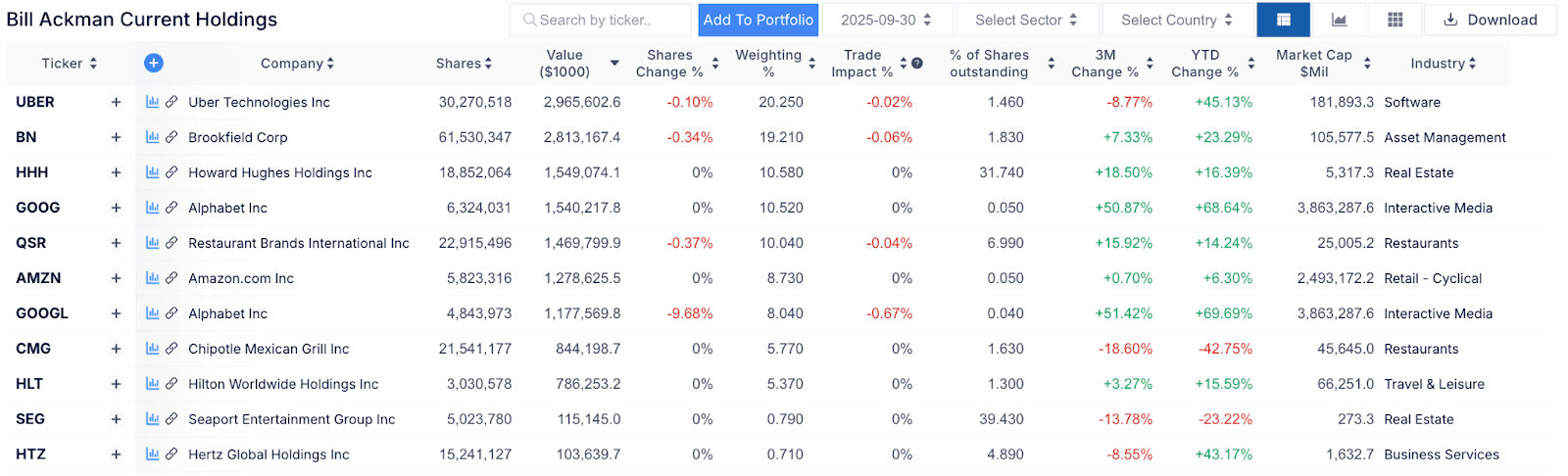

Invoice Ackman’s High 10 Holdings, supply: GuruFocus.com

Nevertheless, this quarter is a fairly boring one for Invoice’s portfolio. His portfolio is nearly unchanged, holding a large 20% place in Uber, betting on the expansion of autonomous driving and the aggressive benefit of this stable compounder.

Try Invoice Ackman’s portfolio on eToro!

Nvidia As An Investor?

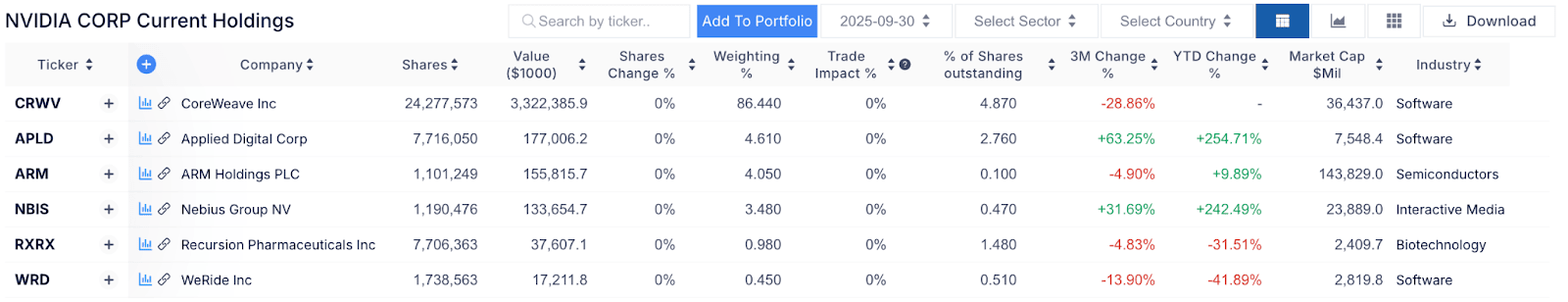

That’s proper! Nvidia additionally manages a large funding portfolio, so it has to report as properly. Whereas it made huge headlines and inventory market strikes prior to now with its AI micro-cap investments, within the final quarter the portfolio was unchanged.

Nvidia’s High 10 Holdings, supply: GuruFocus.com

Nvidia holds a large stake, nearly all of its portfolio, in Coreweave, one of the profitable IPOs of this yr, and likewise its key buyer.

I hope this weblog gave you some inspiration and insights into how the large guys see the markets. It such a risky market, it’s essential to remain up to the mark and have a great deal of high-quality data.

However as you noticed with many of those portfolios, diversification is the important thing to profitable investing. Keep secure on the market!

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.