Companions at companies which have chosen to stay impartial are actually asking whether or not a agency’s inside buyout a number of needs to be adjusted. Some imagine the a number of needs to be elevated to mirror the extra worth that might be captured by promoting externally to non-public fairness or by way of a conventional sale to a different impartial CPA agency.

Processing Content material

CPA agency companions have invested closely of their careers. They’ve sometimes earned an incredible dwelling and stay up for a cushty retirement.

The worth they’ve constructed of their apply can considerably impression how comfy that retirement might be.

Present buyout modifications: ballot outcomes

We polled CPA companies to discover how buyouts are altering in response to PE, and the outcomes have been combined. Some companies have responded by rising their buyout multiples or adjusting associated phrases. Others have decreased their buyout multiples or modified their plans, with the intention to hold retirements inexpensive for remaining companions and incoming companions.

Agency chief feedback associated to elevated buyouts and associated valuation techniques:

- “Elevated the a number of of comp from 2x to 2.5x”;

- “Shorter buyout interval”;

- “Modified the phrases for valuation. Prior to now, it was based mostly on income; present relies extra on profitability.”

Agency chief feedback associated to decreased buyouts and associated succession techniques:

- “Lowered buyout proportion to make retirements extra inexpensive to new companions. Added a cap for the whole quantity we pays every year to retired companions”;

- “Lowered complete payout quantities. Elevated vesting”;

- “Lowered the buy-in worth to make it extra interesting.”

Clawbacks

A number of companies indicated a powerful curiosity in including a clawback. A clawback would permit retirees to share in any elevated worth if the agency is offered throughout their buyout interval, whereas nonetheless giving remaining companions full flexibility to pursue a sale when it makes probably the most sense.

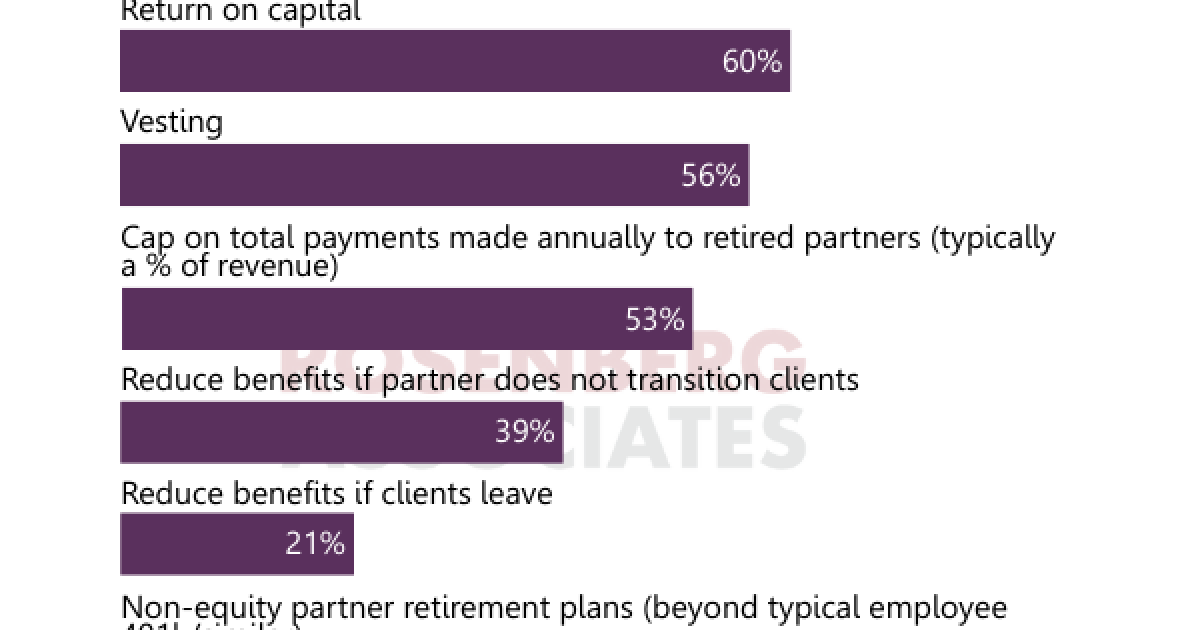

The variety of respondents with a clawback provision at the moment in place was solely 14%, representing a chance to extend as an trade. Different buyout options which are at the moment in place in respondent plans are listed within the following chart.

Contemplated future buyout modifications

Forty p.c of our respondents are contemplating retirement plan modifications sooner or later, and about 71% of these indicated their potential updates are as a result of PE’s deeper involvement within the trade. Modifications some companies are considering different modifications:

- “We’re trying on the steep low cost of the buy-in relative to PE multiples and are contemplating rising deferred comp advantages and/or accrual foundation buyout (or a mix of the 2).”

- “It’s doable we are going to take a look at the PE impact, however the a number of we might obtain from PE would actually drive up the retirement payouts, and we’re undecided we wish to do this from a long-term viability standpoint.”

- “Undetermined [on changes], however the distinction between exterior market valuations and the companion retirement construction is simply too large to disregard.”

- “Having extra correlation between worth creation and seize. Taking up a ebook of enterprise just isn’t creating worth.”

- “Clarifying how the calculations are completed. Maybe decreasing the quantity barely. We’re dedicated to remaining impartial.”

- “Clawback and contemplating barely increased retirement payouts.”

Evaluating your place

Retirement plan modifications to your agency needs to be pushed by technique. What’s the well being of your agency now? How worthwhile is it? How is succession planning trying? What are the monetary and legacy objectives of nearer-term retirees?

The very best decisions are these grounded in your values and preferences. PE could supply the very best financial worth for a agency, supplied the agency is nicely suited to a PE purchaser and vice versa. Many agency house owners, nevertheless, really feel a powerful loyalty to their shoppers and their group — loyalties that they really feel cannot be replicated by promoting.

The choice to alter your agency’s buyout plan is not a straightforward one, given the range of exit methods and practices. Making a considerate, knowledgeable resolution will present the very best final result to your apply and your future.