Ed. be aware: Final in a collection.

You’ve efficiently navigated the pre-merger part. Your deal has closed. Your authorized division has taken the instant mandatory steps.

Now, the actual work of making certain long-term success begins.

Paradoxically, this forward-looking effort might begin with an enormous step again: revisiting the explanations for the deal within the first place and clarifying what “success” even seems to be like.

“You’ve bought to grasp the explanations and worth drivers, proper?” says Josh Hollingsworth, an M&A accomplice with Barnes & Thornburg LLP. “If no one articulates the objectives and really says: ‘That is why we did it, and that is what we’re hoping to do over the following three to 5 years,’ then you definately don’t know.”

On this collection, we’re offering a step-by-step information for common counsel navigating a merger or different company transaction.

Partly one, we explored greatest practices for company regulation departments within the pre-merger part, and partly two, we regarded on the instant steps post-closing.

Right here, we’re eyeing methods regulation departments may help to make sure the long-term success of an built-in firm.

We’ll even be discussing these matters in a January webinar. You possibly can pre-register right here.

First, Have a Plan

Lengthy-term success is essentially a perform of efficient planning: organising processes that may guarantee constructive outcomes, and making a complete guidelines in your regulation division to comply with.

“You’ll want to have the assets in place to really execute the plan,” says Kariem Abdellatif, the top of Mercator by Citco (Mercator), a specialist entity administration supplier that helps organizations handle their world entity portfolios, together with throughout complicated M&A transactions.

“It’s not nearly constructing a plan after which hoping that issues will come collectively – you have to guarantee you’ve got the operational capability and skill to comply with via”

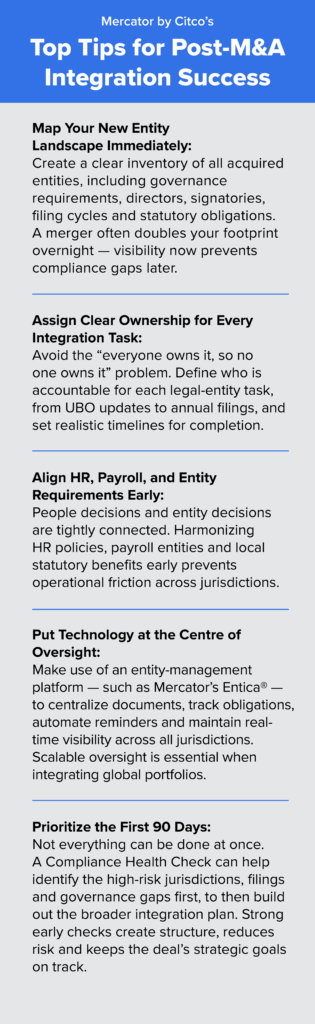

Abdellatif provides that one space usually missed is entity-governance mapping – creating a transparent stock of acquired entities, their governance necessities, and upcoming submitting cycles.

“A merger can immediately multiply the variety of entities you’re liable for,” he says. “With no clear map of governance necessities and renewal cycles for every jurisdiction, important obligations can slip via the cracks.”

Hollingsworth notes that regulation departments concerned in company transactions will usually create a bespoke guidelines that may kick off the long-term work of integration.

There are normal gadgets that may simply be discovered on Google, however organizations might want to customise these to their particular wants.

“The regulation division’s going to wish to have its personal integration guidelines, not simply to ensure that issues aren’t missed, however to verify there’s accountability,” Hollingsworth says. “Is the regulation division liable for this merchandise, or is it another division?”

Don’t Neglect HR

Most of the gadgets in your guidelines will contain the authorized division — points like contract renewal, or consolidating insurance coverage.

However none could also be extra in depth than the human assets points that come up.

One thing as seemingly simple as consolidating profit plans is rife with potential issues. These transcend well being and dental insurance coverage, implicating the whole lot from 401(ok) applications to distant work insurance policies to paid break day.

Combining profit plans raises the chance that the corporate will face a tricky alternative: both tackle unexpected prices in assembly larger necessities, or alienate a big portion of the workforce by reducing their advantages.

Further issues usually come up when merged entities retain separate applications, Hollingsworth notes.

When workers on the identical degree have completely different PTO allotments, for instance, such a disparity will create administration points.

“That sort of human useful resource stuff actually can drive folks mad,” Hollingsworth says, “which is likely one of the causes I feel lots of firms attempt to combine all of it, as painful as it’s.”

Put together for New Jurisdictions

Whereas your organization presumably entered a transaction based mostly on sure worth drivers, understanding any compliance points that may come up in new jurisdictions will assist you hit the bottom working.

Abdellatif notes that the merged firm is now liable for entities in every new jurisdiction on Day One, and this must be addressed by the authorized division.

“Abruptly you end up liable for a portfolio of entities in nations that you simply’ve by no means operated in earlier than – with unfamiliar authorized techniques, languages and regulatory expectations.” he says. “So gaining sensible data of how you can truly run a portfolio of entities within the Gulf area, APAC, or South America turns into important”.

Even when the CEO of the merged firm directs the authorized division to take a comparatively hands-off method to a brand new entity post-merger, obligations nonetheless come up for the corporate’s attorneys.

The authorized division will nonetheless must oversee all the items in its group, whatever the broader method to enterprise administration, Hollingsworth notes.

“If it’s a part of what I’m liable for, I’m going to should be concerned, proper?” he says. “I’m going to wish to have conferences and ask questions and implement processes — or at the very least ask what they’re.”

“A part of that oversight is having a system or working with a supplier that provides you visibility into filings, native relationships, signatory authorities, and upcoming deadlines so you may prioritize what issues most,” Abdellatif says. “Visibility drives triage; with out it you’re reacting as a substitute of planning.”

Put together for the Surprising

Even with sturdy due diligence, some unexpected compliance points should slip via the cracks and come up post-merger.

Possibly an underground storage tank that no one knew about raises environmental considerations, or possibly a union downside may very well be growing.

If such a difficulty is dropped at the eye of the authorized division, there are a selection of steps to take.

Step one for the GC is to notice whether or not that is an ongoing or one-off concern, Hollingsworth says.

“If it’s an ongoing concern, we’ve bought to cease, and we’ve bought to begin complying with the regulation right this moment.”

Going again to the acquisition settlement can be a important step. Legal professionals might want to decide if any misrepresentations had been made, and whether or not any authorized claims might come up underneath the phrases of the deal.

Sometimes, there are deadlines to make any claims, and these must be rigorously calendared by the authorized division post-merger.

The GC must also decide what insurance coverage is in play — whether or not it originates with the bigger entity or the corporate that was acquired.

“I feel after you’ve got an evaluation of the information and the authorized circumstances, then at that time you’re going to herald the leaders of the enterprise, after which they’re going to finally make the decision about what to do about it,” Hollingsworth says. “However there’s lots of fact-finding and investigation earlier than that.”

Abdellatif notes that many “surprises” are literally governance points ready to be found — dormant subsidiaries with legacy liabilities, lacking UBO information, or incomplete statutory registers. That’s why a compliance well being verify is so helpful in the course of the due diligence part.

“We regularly see instances the place native entity paperwork are incomplete or outdated,” he says. “Figuring out these points early helps you to mitigate operational and monetary threat earlier than they grow to be crises.”

Preserve Your Infrastructure

It’s no secret that regulation departments are dealing with ever better calls for for effectivity, and to stay aggressive they have to keep efficient techniques.

Since a lot of the merger course of primarily entails logistics, the suitable tech may be transformative, Abdellatif notes.

“You need a accomplice who can preserve all of the logistics and particulars underneath management,” he says, “so the good minds within the M&A division can keep centered on negotiations and strategic outcomes somewhat than being caught with the executive burden.”

“After a merger, the quantity of entity knowledge, signing workflows, and jurisdiction-specific obligations can double in a single day,” Abdellatif explains. “The true problem is not only managing the info however centralizing it so world management can belief it.”

“Know-how provides you auditability and scale. Folks will nonetheless make selections, however expertise prevents the only administrative gadgets from derailing these selections.”

Closing Thought

Lengthy-term success after a merger requires the identical issues that make any complicated program work: a transparent plan, accountable house owners, the suitable data, and the infrastructure to make well timed, auditable selections.

That blend of technique, governance, and logistics is the place authorized groups can add monumental worth — and the place specialist entity administration companions and oversight instruments could make integration quicker, safer, and extra predictable.

“Integration is essentially an train in aligning folks, processes — and entities,” Abdellatif says. “In case you put together for these three issues from Day One, you give the newly merged firm one of the best likelihood of reaching the strategic objectives that justified the deal within the first place.”

Keep tuned for our January webinar on the matters addressed on this collection. You possibly can pre-register right here.