The Day by day Breakdown dives into Meta, which has underperformed the S&P 500 to date in 2025 as traders query its AI spending.

Earlier than we dive in, let’s be sure to’re set to obtain The Day by day Breakdown every morning. To maintain getting our each day insights, all it is advisable do is log in to your eToro account.

Deep Dive

Meta Platforms is a set of social media and communication functions, with its core Household of Apps consisting of Fb, Instagram, Messenger, and WhatsApp. The corporate’s Actuality Labs section develops digital and augmented actuality {hardware}, software program, and content material to help immersive experiences.

At one level, shares had been up roughly 36% on the 12 months — and greater than 65% above the April low — however after the current pullback, they’re now up simply 11.5% in 2025. Whereas that efficiency is just not essentially unhealthy, it does path the S&P 500’s year-to-date acquire of greater than 17%.

So what went fallacious?

Meta has been on a significant spending spree, with capital expenditures surging because it invests closely in AI. Different giant tech corporations, together with Microsoft, Amazon, and Oracle, are additionally spending aggressively, however traders have been extra keen to punish Meta for its tempo of funding. Arguably, that response is wholesome, because it suggests traders are implementing some stage of fiscal self-discipline. Living proof: Meta shares rallied on information that the corporate was decreasing its metaverse investments.

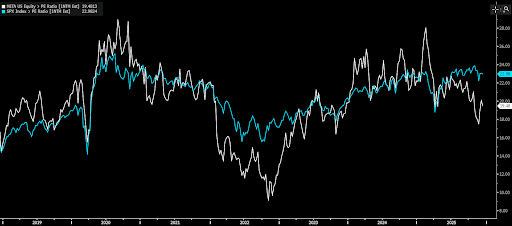

Because the chart above reveals, working earnings proceed to climb — an indication that the underlying enterprise stays robust — however rising capital expenditures are weighing on Meta’s substantial free money move.

Future Development Projections

Right here’s the place it will get fascinating. Analysts anticipate a slight earnings decline in 2025, however as soon as the corporate strikes previous that 12 months, forecasts for 2026 by way of 2028 name for double-digit earnings progress within the mid-teens. Income progress estimates are equally strong. If Meta executes properly, its valuation may transfer even decrease as earnings enhance.

Based on Bloomberg, analysts challenge the next:

- Earnings Development: -5% in 2025, 15.9% in 2026, and 14.3% in 2027

- Income Development: 21.2% in 2025, 18.1% in 2026, and 15.7% in 2027

Analysts at present have a consensus value goal of ~$830 on Meta inventory, implying about 27% upside to in the present day’s inventory value.

Need to obtain these insights straight to your inbox?

Join right here

Diving Deeper — Valuation

The S&P 500 trades at roughly 23 instances its subsequent 12 months of earnings, whereas Meta at present trades at about 19.5 instances ahead earnings. You possibly can see how equally the S&P 500 and Meta commerce on this foundation, with the latter making a notable break decrease over the previous few months.

Now bulls are questioning the place the ground could be for Meta. In November, shares discovered help within the $580s — which represented a ahead P/E of roughly 17.5x. Since 2020, Meta has sometimes established a help ground between 15x and 17x ahead earnings expectations. On the upside, META shares are inclined to lose momentum round 28x. Nevertheless, it’s price noting that over the past bear market, the inventory traded at lower than 10x ahead earnings, so there’s a danger that its valuation can transfer decrease.

Dangers & Backside Line

Meta bulls are in a troublesome place. On one hand, they need the corporate to take a position closely in its future so it doesn’t fall behind within the AI race, particularly as AI clearly advantages Meta’s underlying enterprise. Alternatively, they don’t need the corporate to overspend, though administration has proven a willingness to rein in spending to guard the financials and ease investor considerations.

Market-wide volatility and an financial slowdown are dangers practically all corporations face — Meta included. However as the corporate strikes previous a difficult 12 months of comps (2024 was an ad-heavy election 12 months), its progress hurdles ought to turn into simpler. When mixed with an affordable valuation and strong long-term progress expectations, bulls might discover Meta interesting. Nonetheless, others might argue for decrease costs, pointing to elevated spending and a decrease valuation trough as their justification.

Disclaimer:

Please observe that resulting from market volatility, a few of the costs might have already been reached and eventualities performed out.