This yr hasn’t been straightforward to navigate for enterprise leaders, however Chief Government’s newest CEO Confidence Index finds renewed hope among the many nation’s enterprise chiefs. CEO confidence jumped greater than 10 % within the first week of October, to land at 5.7 on our 10-point scale, the second highest ranking of the yr since January’s 6.3/10.

CEOs’ outlook for the yr forward additionally improved, lastly climbing out of “Weak” territory (the place it spent many of the yr) into “Good” territory—although simply barely, at 6.0 out of 10, the precise “Good” marker on the size. That’s an 8 % soar since September (5.5) and a 6 % enchancment over present circumstances.

Few CEOs supplied rationale for his or her optimism on this month’s survey, although some cited the hope of decrease rates of interest and deregulation as prime drivers, whereas others mentioned their sector was merely performing effectively.

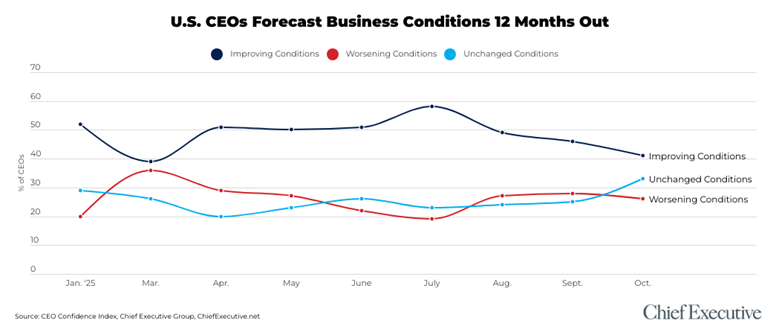

Nonetheless, simply 41 % of CEOs say they anticipate significant enchancment within the yr forward, down from 46 % in September. It’s the lowest proportion since March, when the tariffs announcement despatched confidence plummeting to multi-year lows. These findings recommend CEOs are extra comfy with the place we’re in the present day than the place they had been only a month in the past, however they’re additionally much less satisfied that enterprise within the U.S. is on the cusp of a major upswing.

“The impression of tariffs is having a dragging impression on manufacturing, with increased prices, whereas on the similar time slowing progress,” mentioned Marvin Cunningham, president of Lengthy-Stanton Manufacturing, a virtually 200-year-old steel stamping household enterprise in Ohio. “I’ve a number of prospects which are within the technique of liquidating as they can not proceed to do enterprise on the present tariff ranges. Shedding their enterprise will make it more durable to attain any progress subsequent yr, and we’re projecting a +10 % discount in gross sales.”

Even amongst those that forecast enhancements over the approaching months, the final sentiment is that circumstances will stay subdued. As one mid-market CEO within the building business put it: “May very well be significantly better if not for the uncertainty Trump is inflicting.”

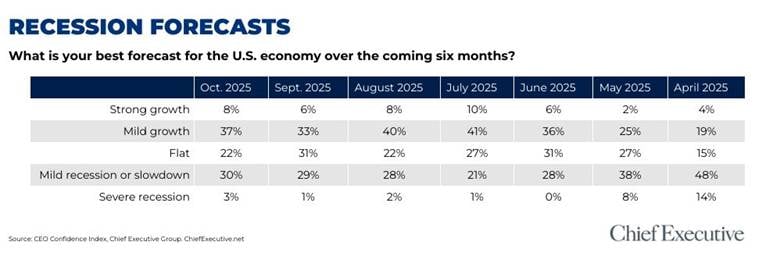

RECESSION FORECASTS

Recession fears have been a major driver of sentiment in 2025. These fears have subsided, giving option to progress forecasts. However whereas the proportion of CEOs anticipating financial progress over the subsequent six months continues to extend, from 39 % in September to 45 %, the proportion anticipating a slowdown can also be rising, from 30 % to 33 % over the identical interval.

“Uncertainty coupled with fears of a market correction make it tough to foretell an upbeat forecast,” mentioned one CEO within the know-how area. “Nonetheless not clear what impression tariffs, authorities shutdown, lackluster job numbers, continued inflation, lack of immigrant staff and different components may have.”

A number of others famous that whereas the tariffs haven’t but brought on a major contraction, as had been anticipated, they nonetheless anticipate these results will transpire sooner reasonably than later. “Finally product and capital funding prices will rise, and employment will stagnate,” mentioned one CEO echoing others.

MID-MARKET OPTIMISM

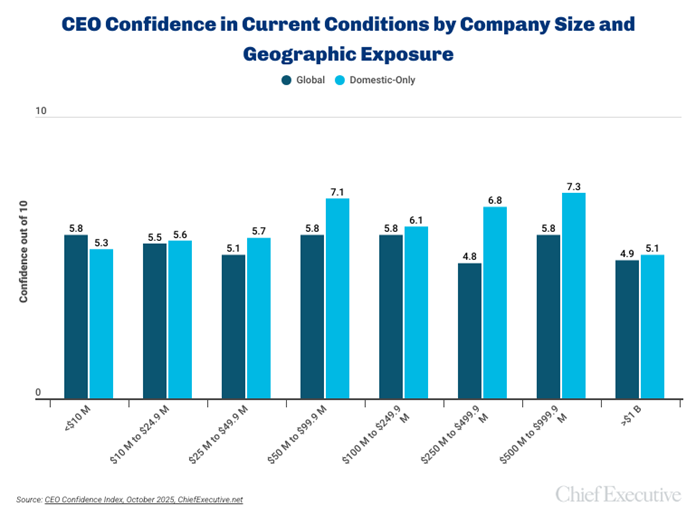

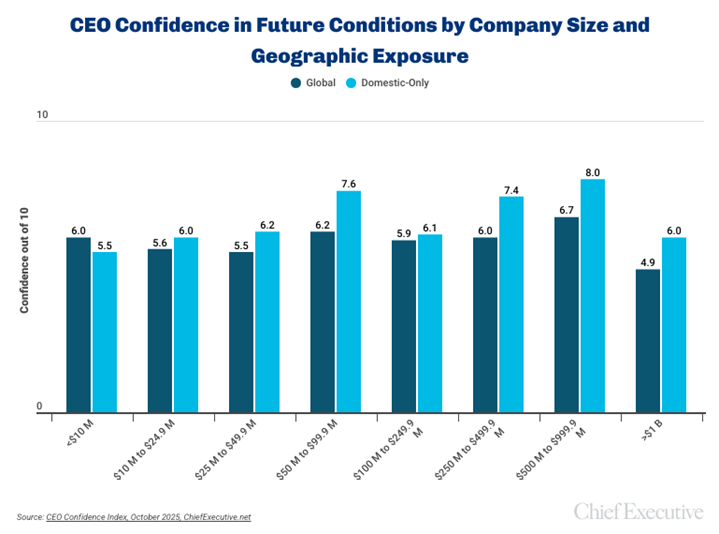

Digging deeper into the information, we discover that the majority of October’s renewed optimism stems from CEOs who lead mid-sized organizations. A comparative evaluation exhibits that the very best scores of each present and future enterprise circumstances are from CEOs at corporations with revenues between $50 million and $1 billion.

Among the many least optimistic? CEOs at corporations of greater than $1 billion.

“Macroeconomic coverage, rising prices, margin pressures and uncertainty are placing a foot on the throat of our business and a number of enterprise. Each time we predict we’re figuring out of it, a brand new tariff or coverage comes out of nowhere that places downward stress on customers and companies,” mentioned the CEO of a giant retail group who expects enhancements in 2026 however solely from a 1 out of 10 in the present day to a 5 by this time subsequent yr.

Massive corporations additionally usually tend to have a better worldwide footprint—thus making them extra vulnerable to the whipsawing dynamics of Trump administration tariff coverage and ever-changing geopolitical conflicts.

“There may be not a strong client market in any of the worldwide segments that we serve,” mentioned a big client manufacturing CEO. “Chinese language competitors is aggressive, and working to a unique financial equation than Western monetary markets (e.g., keep export quantity and maintain individuals employed vs. pure revenue motive).”

As you’d anticipate, the October knowledge finds companies that function solely within the U.S. typically report better optimism than their friends with world operations. Amongst companies sized $250 million to $500 million, for instance, domestic-exclusive CEOs present a ranking of present circumstances at 6.8 out of 10––42 % increased than those that function globally.

The Yr Forward

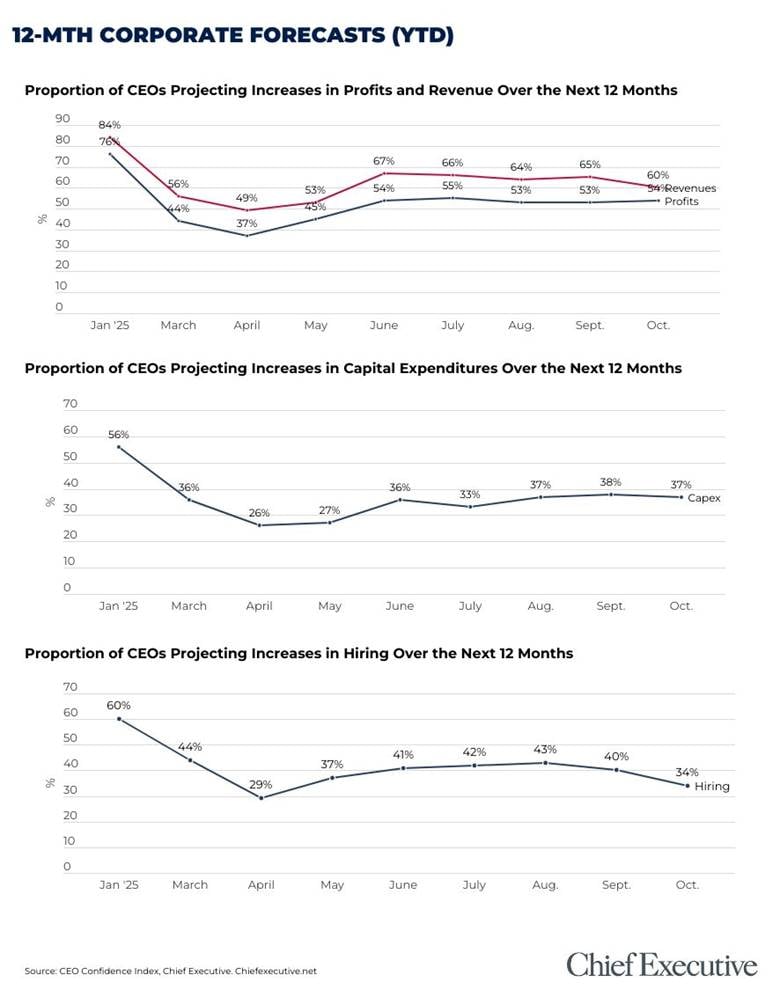

Trying extra particularly at how all it will impression their respective corporations, CEOs report:

- 60 % anticipate rising revenues within the yr forward, vs. 65 % who forecasted progress one month prior.

- 54 % anticipate to extend profitability, vs. 53 % in September.

- 37 % plan to extend capital expenditures, vs. 38 % in September.

- 34 % plan so as to add to their headcount, down from 40 % only one month in the past.

“Persistent federal administration selections are everywhere,” mentioned one mid-market manufacturing CEO. “We’re having a tricky time forecasting and pricing.”

“Uncertainty continues to be an issue with unemployment sneaking up, political quagmires, the fed unconsciousness and unpredictable tariffs,” mentioned the CEO of a middle-market industrial manufacturing firm with worldwide operations.