Simply two months in the past, CEOs collectively breathed a sigh of aid, as tariffs for many international locations went into impact and the Huge Stunning Invoice ushered in guarantees of juicy company tax cuts and diminished regulation, giving enterprise leaders hope that they might lastly get again to enterprise with a point of planning capability.

That didn’t final lengthy.

Our September CEO Confidence Index polling finds CEOs’ notion of present enterprise situations within the U.S. caught in impartial, at one of many lowest ranges of the yr nonetheless: 5.1 (measured on a scale the place 1 is Poor and 10 is Wonderful). That’s flat from the 5.2/10 in August, 8 p.c decrease than July and 19 p.c decrease than the place CEO perceptions have been in January.

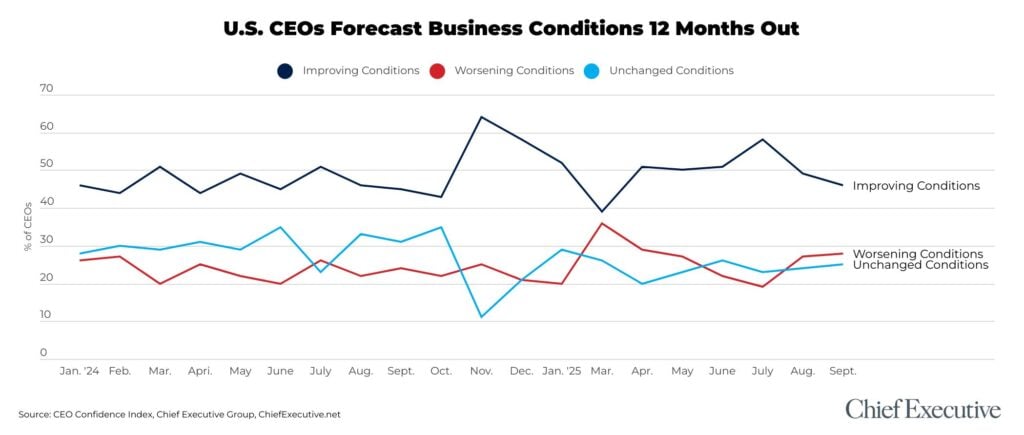

And whereas CEOs forecast the financial system 12 months from now will attain 5.5/10—a wholesome 8 p.c greater from what it’s at this time—their score is the second consecutive month-to-month decline of their outlook, from 6.8/10 in July to five.7/10 in August.

“Inconsistency and instability from DC makes planning extraordinarily troublesome proper now, and inflationary prices that may be absorbed have been absorbed. These are actually being passed-through to customers. It’s a tricky local weather for sustaining progress,” mentioned David Reimer, CEO of The ExCo Group.

“Evolving tariff setting is decreasing enterprise confidence and rising prices,” agreed Tim Zimmerman, CEO of Mitchell Steel Merchandise.

The CEO of a wholesale producer agreed: “[The outlook] is extremely depending on stabilization of worldwide commerce and tariffs. Too exhausting for folks to create methods when the bottom strikes each 30-60 days.”

Most of the CEOs polled mentioned they noticed rising proof that the Trump administration’s insurance policies have been beginning to sluggish the general financial system. “[There is] demand uncertainty attributable to tariffs. We proceed to see softness in a number of segments of our enterprise that’s pushed by prospects taking cautious approaches to their companies, together with very tight stock administration, as they wait to see how tariffs in the end play out,” mentioned the CEO of a publicly traded international producer.

“The administration insurance policies will not be predictable and should create an setting conducive to stagflation,” mentioned the CEO of a mid-market monetary providers agency.

Nonetheless, some are seeing enhancements in pipelines and proceed to hope that this era of uncertainty will result in a greater enterprise local weather.

“The tariff scenario is at the moment freezing many customers from making capital tools purchases. If this technique can stabilize, and rates of interest can come down, issues ought to enhance,” mentioned the CEO of a PE-backed international producer.

“Even with all of the tariff noise, inflation isn’t as dangerous … particularly on merchandise made in America. A yr from now, as tariff considerations fade, the deportation turmoil settles and new favorable tax legal guidelines take impact, firms like ours, with little worldwide publicity, will see actual advantages,” mentioned Andrew Ly, CEO of Ly Brothers Company.

General, simply 46 p.c of CEOs surveyed mentioned they now anticipated the financial outlook for the approaching yr to enhance, the bottom degree since March and on par with CEO rankings all through 2024. These anticipating situations to deteriorate within the yr forward ticked up barely in September, to twenty-eight p.c—greater than it was in 2024.

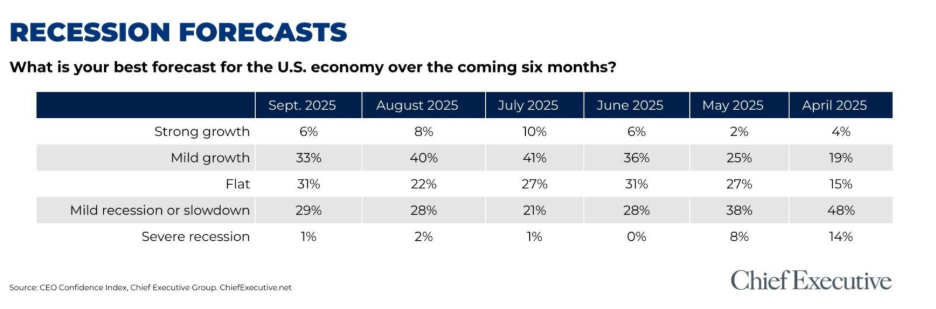

RECESSION ODDS

In our September polling, 29 p.c of CEOs surveyed mentioned they now anticipate a recession within the subsequent six months, versus 28 p.c final month and 21 p.c in July (recession fears peaked at 48 p.c amid the tariff rollout in April). The variety of CEOs anticipating progress within the subsequent six months fell from 48 p.c final month to 39 p.c on this month’s ballot.

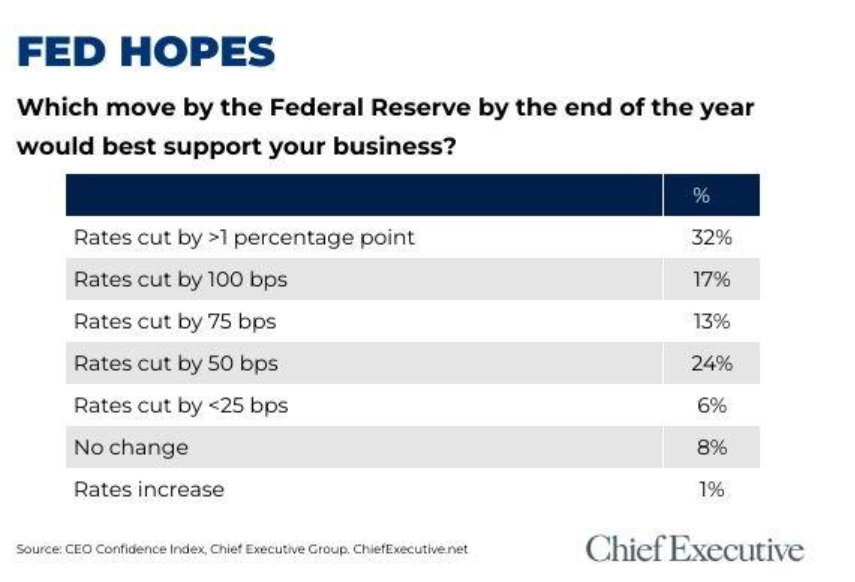

THE FED’S ROLE

Requested what they wish to see from the Federal Reserve by the tip of the yr, 92 p.c of CEOs responded they need to see deep price cuts. Almost two-thirds mentioned they’re hoping for the Fed to chop charges by no less than 75 foundation factors, with a 3rd asking for a share level or extra. Solely 6 p.c mentioned they’d be proud of a 25 bps minimize.

Ought to the Fed not present the anticipated cuts, CEOs anticipate the end result to vary from persevering with “flatness” and margin stress to broader financial pressure, together with delayed capital investments, layoffs and diminished demand.

“And not using a stimulus to the financial system I anticipate additional deterioration of client sentiment and a weakening financial system,” mentioned the CEO of a big North American leisure firm.

“The group will have to be formed for doubtlessly a smaller scale and shield the income, whereas searching for very strategic initiatives in new merchandise and labor discount by way of automation,” mentioned the CEO of a staffing company.

“Further will increase can be handed to prospects to fight the rising price of insurance coverage and wish to extend wages,” mentioned the CEO of a family-owned enterprise.

“We can be seeking to restructure our enterprise and doubtlessly shutter capability,” mentioned the CEO of a publicly traded client manufacturing firm.

The 12 months Forward

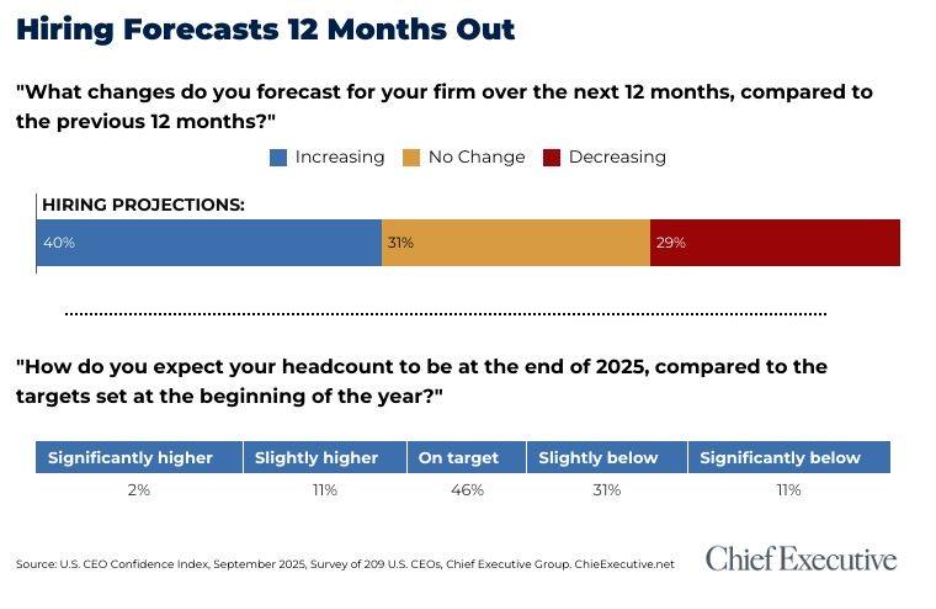

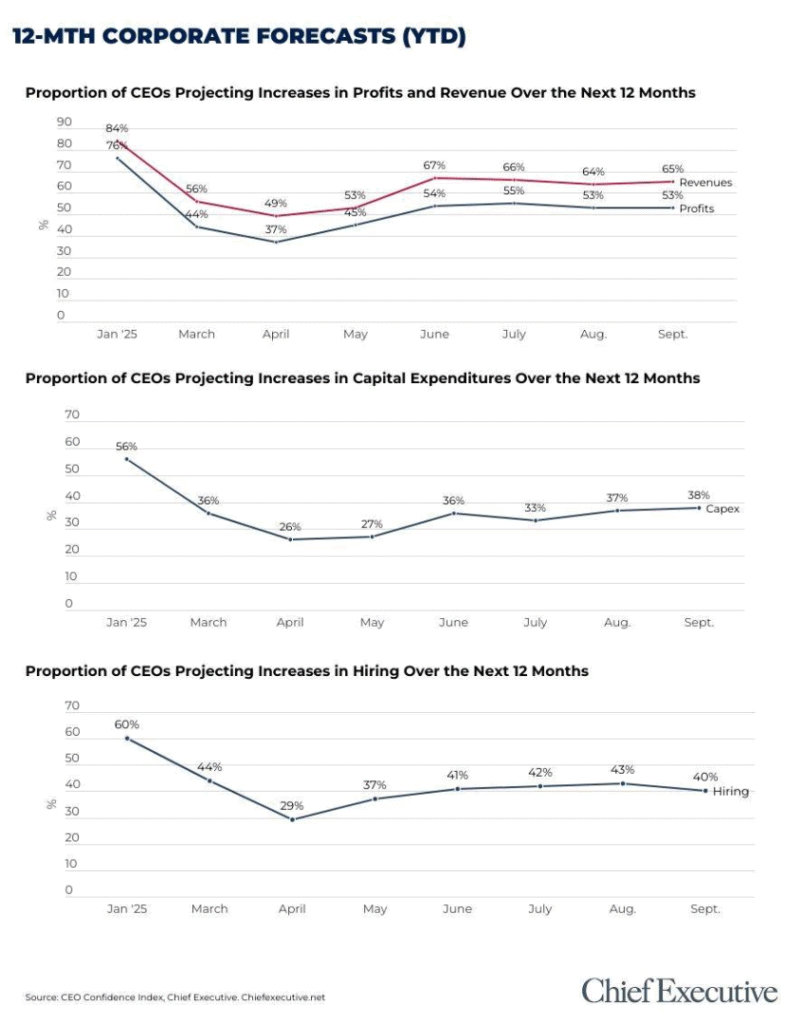

Company forecasts for the yr forward have been holding pretty regular over the previous few months, however CEOs say their firms are nonetheless falling wanting their 2025 targets.

- 65 p.c anticipate income to develop within the yr forward, however 57 p.c say they anticipate to finish the yr beneath their 2025 goal.

- 53 p.c anticipate income to extend within the subsequent 12 months, however 54 p.c anticipate to finish the yr beneath goal.

“Development is generally stealing market share from underperforming opponents which are shedding folks and chopping providers,” mentioned one CEO. “We’re capable of stay excessive contact with purchasers and being non-public with a decrease overhead than our opponents is permitting us to take market share.”

With regards to hiring, CEOs are break up: Whereas solely 40 p.c plan so as to add to their headcount over the following 12 months (down from the 49 p.c common of 2024), 46 p.c say they’re truly on course for the yr—and 41 p.c say they’re falling wanting targets.

Of these falling wanting targets this yr, most blame the general price of labor and the issue discovering expert, dependent staff as the first headwinds, although a number of talked about capitalizing on AI to shore up that hole.

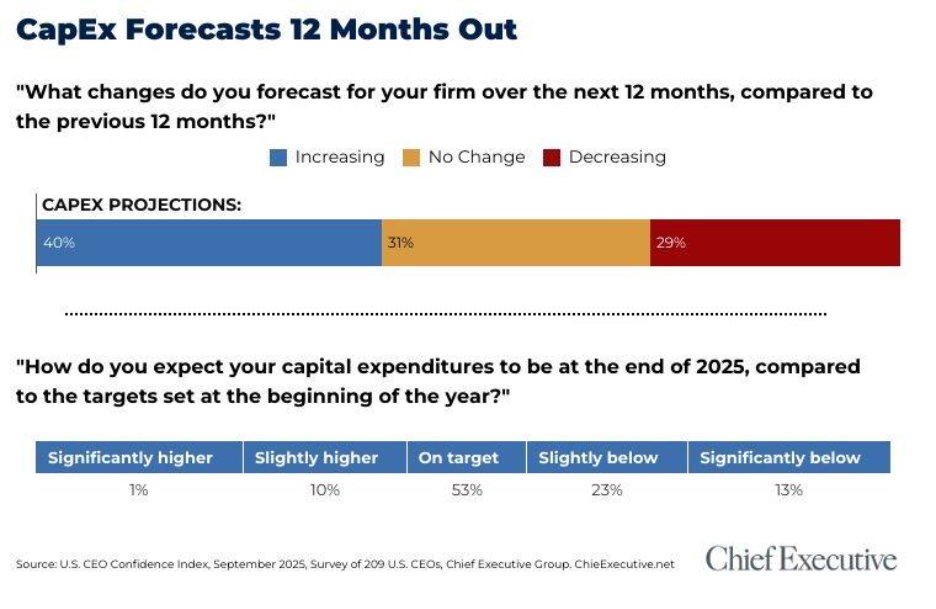

One space bucking the development: capital expenditures. Whereas solely 38 p.c plan to extend these investments within the subsequent 12 months (down from the typical of 46 p.c in 2024), 53 p.c say they’re on monitor to finish 2025 on course.

Maybe a bit of excellent information is that the impression of inflation on the price of doing enterprise seems to be easing: 66 p.c of CEOs now anticipate operational expenditures to proceed to extend within the yr forward, vs. 81 p.c again in April.

Concerning the CEO Confidence Index

Since 2002, Chief Govt Group has been polling a whole bunch of U.S. CEOs at organizations of every kind and sizes, to compile our CEO Confidence Index information. The Index tracks confidence in present and future enterprise environments, based mostly on CEOs’ observations of varied financial and enterprise parts. For added details about the Index and prior months information, go to ChiefExecutive.web/class/CEO-Confidence-Index/