Analyst Weekly, October 13, 2025

China Tensions Rising Once more

What Occurred: Beijing expanded export restrictions on rare-earth supplies vital to AI and semiconductor manufacturing, launched an antitrust probe into Qualcomm, and launched new port charges forward of US measures on giant Chinese language vessels (efficient Oct. 14). In response, the US President threatened tariffs of as much as 100% on Chinese language imports and signaled extra export controls on delicate applied sciences.

Funding Takeaway: In our view, latest actions level to renewed friction reasonably than collapse within the US–China commerce dialogue. Whereas excessive tariffs may in the end weigh on tariff revenues and holiday-season provide, each governments seem targeted on strategic positioning reasonably than outright disengagement. Further measures on plastics, chips, and doubtlessly energy-linked commerce (China’s oil dealings with Russia) may observe.

- Quick time period: Rising coverage uncertainty could preserve export-heavy and China-exposed sectors beneath strain ({hardware}, autos, transport).

- Medium time period: US high quality and domestically oriented equities stay higher positioned amid a extra self-sufficient industrial coverage.

- Long run: Industrial self-sufficiency, semiconductor independence, and supply-chain resilience stay central themes.

Coverage-driven Industrial Revival

Washington’s “sovereign wealth” like investments, focusing on US Metal, Intel, MP Supplies, Lithium Americas, and Trilogy Metals, sign a structural pivot towards home manufacturing of vital supplies and chips.

Funding Takeaway: Lengthy-duration help for US metals, rare-earth, and semiconductor supply-chain names as these companies change into central to nationwide security-linked manufacturing. Corporations impacted:

- US Metal (X) – metal capability and reshoring narrative.

- MP Supplies (MP), Lithium Americas (LAC), Trilogy Metals (TMET) – vital minerals, uncommon earths, and EV-supply inputs.

- Intel (INTC) – CHIPS Act capital infusion and geopolitical choice over Asia-based friends.

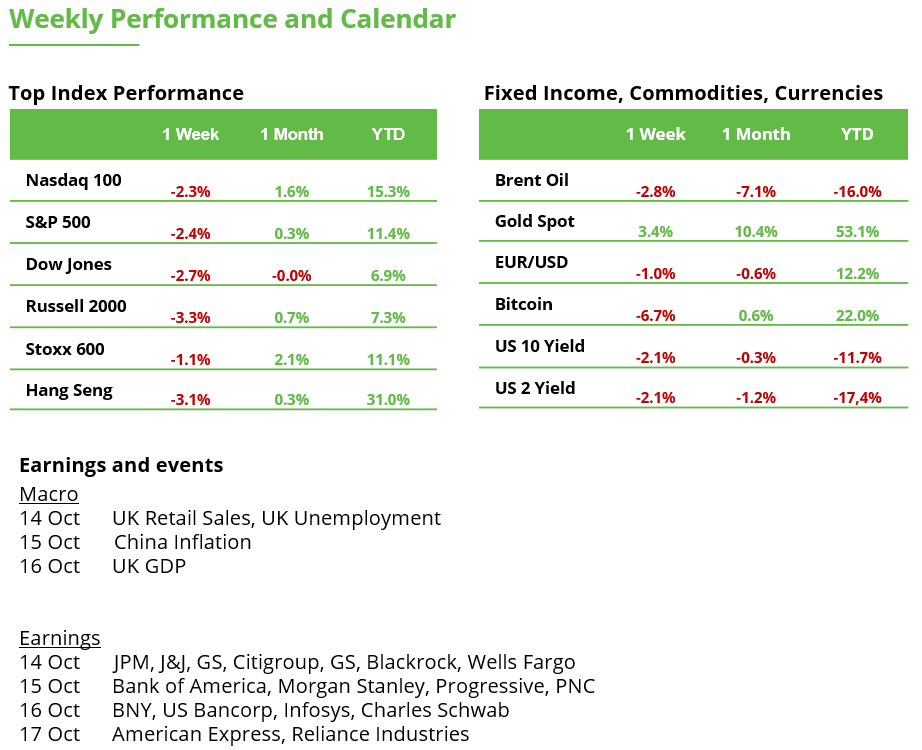

Earnings Preview: Main S&P 500 Corporations Reporting October 13–17, 2025

The week of October 14-18, 2025 marks a key kickoff to the third-quarter 2025 earnings season. A slew of main US corporations, spanning banking, healthcare, client, and industrial sectors, are set to report outcomes. Traders can be dissecting these studies for clues on financial well being and company-specific traits.

- JPMorgan Chase & Co. (JPM): A “rebound in funding banking” is predicted to elevate earnings. Traders will give attention to web curiosity revenue (NII) which has been boosted by greater rates of interest and whether or not administration raises its full-year NII steerage after sturdy good points

- Wells Fargo & Co. (WFC): Traders will search for any change to NII steerage given fee strikes and deposit traits in Q3. The road will give attention to any commentary on decreasing expense ranges.

- The Goldman Sachs Group (GS): Goldman’s backlog of offers and commentary on the M&A outlook can be key; buyers need to know if the Q3 surge is sustainable or “one-off.”

- BlackRock Inc. (BLK): Fund flows are the lifeblood of BlackRock’s progress. Any commentary on investor preferences (e.g. shifting into bond funds given greater yields) can be worthwhile.

- Citigroup Inc. (C): Citi’s multi-year revamp means it’s incurring expenses to streamline administration layers and divest sure models. Traders are laser-focused on expense management: will the Q3 outcomes present effectivity bettering?

- Financial institution of America Corp. (BAC): Like friends, BofA faces inflationary pressures on prices (wages, tech spend). Any point out of effectivity enhancements or areas of value self-discipline (e.g. department community optimization) can be welcomed.

- PNC Monetary Providers (PNC): Regional banks in 2025 have confronted strain from prospects reallocating deposits to higher-yielding choices (so-called “deposit beta” strain). Traders will watch how PNC’s deposit balances and prices fared in Q3. Credit score high quality is one other focus.

- Johnson & Johnson (JNJ): Traders will give attention to administration’s commentary across the firm’s pharmaceutical pipeline momentum and on sustained MedTech progress.

- Progressive Corp. (PGR): Insurer more likely to point out that it’ll keep pricing self-discipline even after gaining over a degree of auto insurance coverage market share, and can carefully monitor claims value traits (like auto restore inflation and disaster losses) to maintain its superior underwriting efficiency.

- United Airways (UAL): Traders can be tuned into the service’s value steerage; United expects a tailwind from decrease gas costs serving to Q3 outcomes.

- American Specific (AXP): Traders will give attention to whether or not American Specific can maintain sturdy premium card spending and mortgage progress whereas sustaining credit score high quality.

Crypto Bought Crunched

Final Friday, crypto confronted one among its ugliest hours ever. Bitcoin plunged 15% in about an hour, Ethereum slid 20%, and a few altcoins acquired halved. A record-breaking liquidation occasion that noticed practically $20 billion in leveraged positions worn out in simply at some point.

What sparked it:

Tariff tensions between the US and China lit the fuse, however the explosion got here from inside. The market was over-leveraged and paper-thin on liquidity.

The way it unraveled:

Perpetual contracts, the go-to weapon for merchants, grew to become the set off. As leveraged longs acquired liquidated, automated promote orders snowballed, wiping out over half of world open curiosity in beneath two hours.

The massive image:

It’s noteworthy that regardless of the size of the occasion, Bitcoin has already recovered to round $115K on Sunday, reflecting its rising resilience and market maturity.

Takeaway for buyers:

- Keep away from devices with out actual depth.

- Favor direct, clear, and custodied publicity.

- Deal with crypto as infrastructure, not a fast gamble.

SPDR S&P Financial institution ETF Defends Quick-term Help Zone

The SPDR S&P Financial institution ETF slipped by practically 1% final week, extending its shedding streak to a 3rd consecutive week. Nonetheless, the bulls managed to defend the truthful worth hole between 56.41 and 57.36, a zone that emerged from the sharp rally in August and now serves as a key help space.

So long as this vary is just not sustainably damaged to the draw back, the uptrend construction, characterised by greater highs and better lows in latest months, stays intact. From a technical perspective, this means {that a} continuation of the pattern is the most definitely state of affairs.

For the uptrend to renew, nonetheless, patrons might want to overcome the truthful worth hole between 60.93 and 61.38, an vital resistance zone the place the ETF has already failed a number of occasions. The upcoming earnings season will seemingly decide whether or not a brand new breakout try is on the horizon or if the help zone can be examined once more.

SPDR S&P Financial institution ETF, weekly chart. Supply: eToro

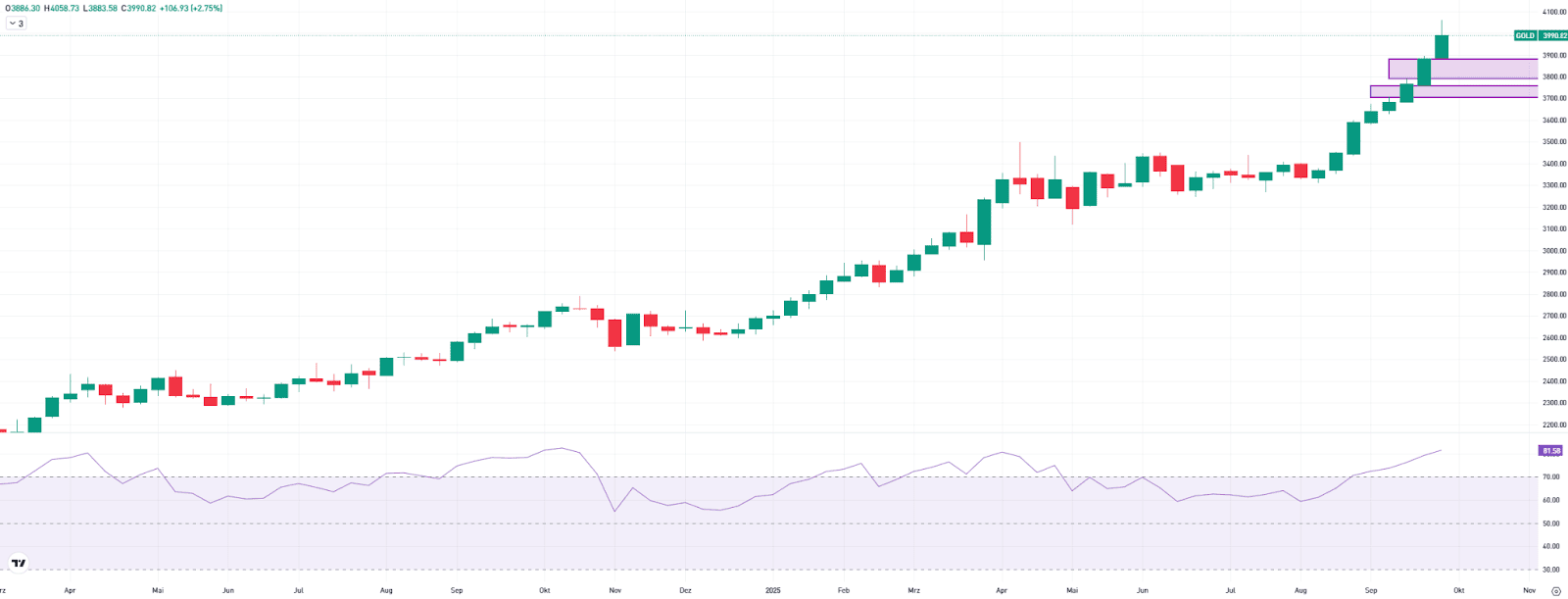

Gold: Report Excessive and Overheating on the Similar Time?

Gold rose by 2.75% final week, marking a brand new all-time excessive. At one level, the value even climbed above $4,000, leaving little doubt in regards to the power of the uptrend.

Nonetheless, the short-term upward impulse now seems to be tremendously overstretched. It was already the eighth consecutive week of good points, and the RSI, at over 81, is flashing clear indicators of overheating. For the reason that starting of the 12 months, gold has gained greater than 50%.

An overbought market doesn’t essentially imply {that a} correction is imminent. Nonetheless, a pullback can be wholesome to ease the overheated state of affairs. Such consolidation phases can final for a number of weeks and are sometimes accompanied by the RSI dropping again beneath the 70 stage.

The primary key help zones are the truthful worth gaps between $3,790 and $3,883 in addition to $3,707 and $3,762. Traders ought to carefully monitor how the value behaves in these areas if the gold value experiences a short-term pullback.

Gold, weekly chart. Supply: eToro

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.