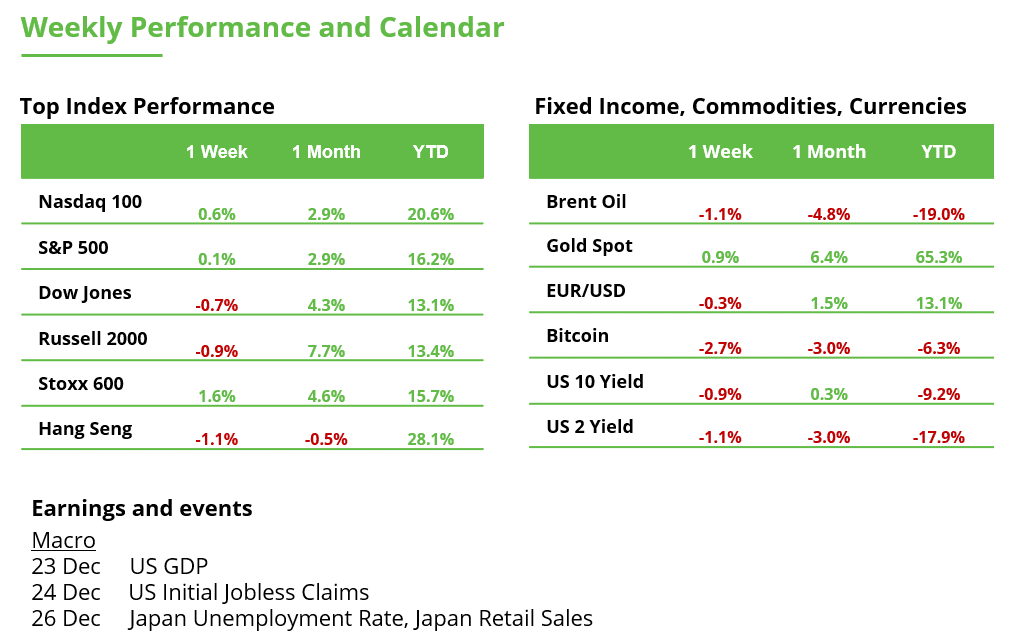

Analyst Weekly, December 22, 2025

After spending a lot of the previous two years within the penalty field, financials are quietly staging a comeback. Earnings are bettering, capital markets are thawing, and valuations are beginning to look extra just like the pre-crisis period than the post-GFC hangover. However selectivity is vital: this restoration is uneven, and never everybody will get a trophy.

Earnings: Doing Extra Than Simply Surviving

Financials delivered their second-strongest earnings season within the S&P 500, clocking ~25% year-over-year progress, trailing solely Tech. The basics are sturdy: increased buying and selling revenues, document investment-grade debt issuance, and early indicators of life in IPOs and M&A.

Analysts are taking discover. Earnings revisions for each 2025 and 2026 are optimistic throughout most Financials sub-industries, with banks and client finance main the pack.

Capital Markets Are Waking Up

2025 has formed as much as be the second-highest yr ever for investment-grade issuance, powered by AI-driven capex, refinancing wants, and massive company stability sheets lastly pulling the set off. M&A volumes are working above 2021 ranges, even when some mega-deals are taking their time to shut. IPO volumes are monitoring close to long-term averages after the 2022-2023 freeze.

Valuations

Right here’s the place it will get attention-grabbing. Financials are drifting again towards pre-GFC return-on-equity and price-to-book profiles. That creates room for additional a number of enlargement, particularly as earnings proceed to enhance and regulatory strain eases. In contrast with different cyclical sectors, Financials nonetheless look fairly priced for the expansion they’re delivering.

Coverage Is a Tailwind

Macro coverage is lastly cooperating. Expectations for extra accommodative financial coverage in 2026, mixed with a lighter regulatory contact, might assist offset current tightening in monetary situations. Decrease compliance prices and a friendlier backdrop for lending and capital markets are precisely what the sector wants to increase this restoration.

The Positive Print: It’s a Two-Velocity Sector

Not every part is rosy. Non-public credit score stays the most important danger, with lingering stress after current high-profile defaults. Client charges — bank cards, auto loans, mortgages — are nonetheless elevated, providing solely marginal aid for households. That retains strain on client finance and elements of regional banking.

Winners vs. Laggards

Large banks are nonetheless the spine of the commerce. Names like JPMorgan and Financial institution of America proceed to carry management positions and supply stability. Funding banking and private-credit-exposed names? Nonetheless working by points.

Funding Takeaway: Financials aren’t in a straight-line bull run however they’re now not only a worth lure. With bettering earnings, reviving deal exercise, and valuations that haven’t absolutely repriced, the sector appears like a cyclical comeback story: only one that rewards selectivity over blind enthusiasm.

Crypto Markets: 2026 Outlook

As we method 2026, bitcoin and the broader crypto ecosystem are being formed by a twin transition: a return of macro liquidity and a structural reconfiguration of the mining and vitality panorama pushed by synthetic intelligence. Value motion is at present secondary to positioning, derivatives dynamics, and long-term infrastructure shifts.

Macro Backdrop: Liquidity is Returning

Quantitative tightening is successfully over; markets are transitioning towards financial easing. Charge cuts by the Federal Reserve are largely priced in. Political incentives within the US level to incremental fiscal and financial stimulus forward of mid-term elections. Traditionally, this surroundings is supportive for high-beta, liquidity-sensitive belongings, together with Bitcoin. Brief-term worth weak spot is macro-technical moderately than structural, amplified by international charge changes (notably Japan) and carry-trade unwinds.

Value Motion

BTC is at present consolidating within the $85,000–$90,000 vary, reflecting sideways-to- bearish short-term momentum. Expectation: worth continues to gravitate towards option-dense ranges moderately than trending decisively absent a macro catalyst.

Circulate Dynamics: Weak Fingers vs Affected person Capital

- Quantity has collapsed, signaling a volatility compression section.

- Brief-term flows present:

- Retail promoting small positions beneath stress.

- Bigger gamers putting deep restrict bids, not seen in spot trades.

Conclusion: distribution is retail-led; whales and good cash are ready,

Institutional Positioning & ETFs

Institutional positioning has quietly stabilised and promoting strain by ETF automobiles has slowed meaningfully. On the company aspect, most massive treasury consumers constructed positions between late 2024 and Q3 2025 at worth ranges round $80,000–$90,000 and above, leaving present spot costs near or beneath current institutional price bases. Exterior of MicroStrategy, there are few energetic company consumers at present, however that absence displays digestion moderately than capitulation. The implication is simple: present ranges supply a relative entry benefit versus the place corporates have already dedicated capital.

Funding Takeaway: Liquidity situations are bettering, however near-term worth motion is being pushed extra by derivatives positioning than by long-term holders. Retail sentiment stays fragile, whereas institutional positioning is affected person and largely intact. Traditionally, intervals marked by low volatility, compressed quantity, and narrative discomfort have tended to precede the following main regime shift in Bitcoin’s cycle.

Oil Struggles for Stability: Double Backside or Only a Temporary Pause?

Oil costs closed final week 1.4% decrease at $56.50 per barrel. WTI quickly got here very near the yearly low, which was set in April at $54.83. Towards the tip of the week, nevertheless, costs rebounded, mirrored within the chart by an extended decrease wick.

Whether or not this marks the formation of a medium-term double backside stays unsure at this stage. Additional affirmation can be required, for instance, a transfer again above the $60–$61 space. This zone has been a key battleground since March, alternating between help and resistance.

So long as a sustained breakout above that stage fails to materialize, the chance stays that oil costs come beneath renewed strain and retest the yearly low. A break beneath that stage would suggest a transfer to the bottom worth since January 2021.

Oil worth (WTI) weekly chart. Supply: eToro

Nasdaq 100 Turns Constructive: Is a Push Towards the Document Excessive Subsequent?

Because of a powerful end to the buying and selling week, the Nasdaq 100 managed to totally get better its earlier losses and even ended the week up greater than 0.6% at 25,345 factors. Consequently, the hole to the document excessive from late October has narrowed to lower than 4%.

From a technical perspective, a check of the document excessive seems the most definitely situation given the still-intact uptrend construction. Trying again to December 2024, the setup appears comparable. At the moment, nevertheless, bulls ran out of momentum within the closing buying and selling days of the yr.

Ought to the market come beneath short-term strain, consideration would initially flip to the well-known help zone (honest worth hole) between 23,860 and 23,993 factors. Under that, the following vital help space lies between 21,980 and 22,375 factors. A decline into this second zone would signify a average correction.

Nasdaq 100 weekly chart. Supply: eToro

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.