Because the 12 months creeps into fall, U.S. manufacturing CEOs downgrade their forecast for future enterprise circumstances and their score of present circumstances for the second month in a row in September, citing volatility, tariffs and diminished demand as the principle drivers.

In keeping with Chief Government’s newest CEO Confidence Index survey, performed September 9 and 10, U.S. manufacturing CEOs now forecast enterprise circumstances 12 months down the road at 5.2/10, on a scale the place 1 is Poor and 10 is Glorious. That’s down one other 7 % since final month, after an 11 % lower in August. Now for a 3rd consecutive month, this rating is effectively beneath that reported by non-manufacturing CEOs (5.7/10).

On the subject of their score of the current enterprise surroundings, the consensus is grim. U.S. manufacturing CEOs charge present enterprise circumstances at 4.5/10—their lowest score of present circumstances for the reason that pandemic. Their score additionally alerts a rising hole between the truth of enterprise for U.S. manufacturing CEOs versus these in different industries, who charge present circumstances a comparatively sunny 5.6/10.

Tariffs and commerce coverage are essentially the most ceaselessly cited subjects to clarify manufacturing CEOs’ forecasts with many explicitly mentioning that tariffs are a big supply of uncertainty. Weak demand, rising prices and international instability are additionally in charge for the low rankings this month, in line with manufacturing CEOs.

“Sluggish orders and clients are confirming enterprise has slowed.,” says Leonard Bedell, president & CEO at Mobil Metal Worldwide.

Nonetheless, manufacturing CEOs are hopeful that circumstances will enhance, given stabilization and diminished rates of interest.

“The tariff state of affairs is at present freezing many shoppers from making capital gear purchases,” says the CEO of a worldwide printing gear producer. “If this technique can stabilize, and rates of interest can come down, issues ought to enhance.”

Recession forecasts stay unchanged, with a gentle 30 % of producing CEOs forecasting a gentle or extreme recession over the subsequent 6 months in comparison with 31 % of non-manufacturing CEOs who undertaking the identical.

Nevertheless, over one-third of producing CEOs (35 %) anticipate no progress from the U.S. economic system over the subsequent 6 months, in comparison with solely 28 % of non-manufacturing CEOs. On the intense aspect, an equal proportion of producing CEOs can be forecasting delicate progress.

The Yr Forward

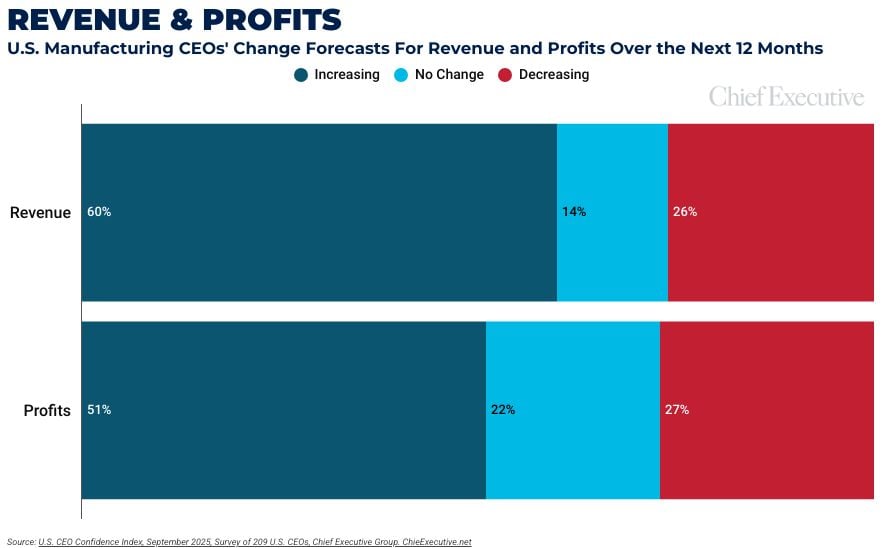

Projections for revenues and revenue are down for manufacturing CEOs in September, for the third consecutive month. Now, solely a really slight majority undertaking rising earnings over the approaching 12 months, at 51 %, down 7 % from the month prior—in comparison with 55 % of non-manufacturing CEOs who undertaking the identical.

Equally, the proportion of producing CEOs forecasting boosted income is down 5 %, to 60 % of producing CEOs vs 68 % of non-manufacturing CEOs. This determine can be down for the third consecutive month.

Nevertheless, it’s value noting that almost all of producing CEOs nonetheless do anticipate income and revenue will increase by 2026, though the proportion is falling.

“A lot of producing has been in a recession over the previous 12 months. It ought to flip by 2026,” says the CEO of a mid-size U.S.-based metal producer and provider.

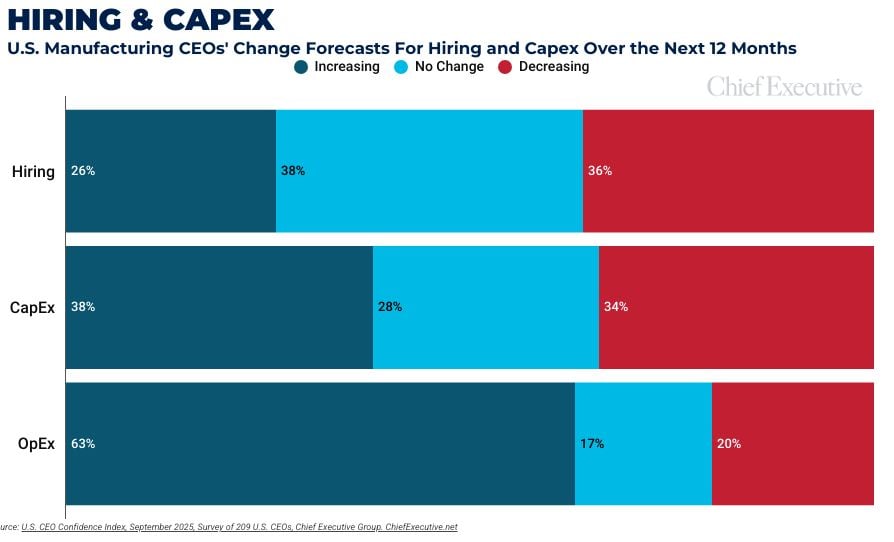

In September, 63 % of producing CEOs anticipate will increase in working bills, down from 69 % the month prior. This isn’t too far off from the 68 % of non-manufacturing CEOs who mentioned the identical this month.

When wanting on the proportion of producers who’re planning to deploy extra capital throughout the subsequent 12 months, it shows a special sample. Up for the second consecutive month, now 38 % plan a rise in capex over the subsequent 12 months in September vs 37 % in August and solely 34 % in July.

Conversely, solely 26 % anticipate to extend their headcount, in comparison with 38 % final month and 44 % in July. The disparity in hiring plans between manufacturing CEOs and CEOs in different industries is now particularly hanging: 26 % versus 48 %, respectively, who plan to extend their headcount throughout the subsequent 12 months. This alerts that producers are pulling again hiring in favor of capital investments, reminiscent of automation to deal with ongoing labor shortage in manufacturing.

“[There is] continued funding into aerospace manufacturing and manufacturing unit automation to deal with labor shortage,” says Terry P. Meier, CEO at Allways Precision, international producer of commercial equipment.

Concerning the CEO Confidence Index

Since 2002, Chief Government Group has been polling a whole lot of U.S. CEOs at organizations of all kinds and sizes, to compile our CEO Confidence Index information. The Index tracks confidence in present and future enterprise environments, based mostly on CEOs’ observations of assorted financial and enterprise parts. For added details about the Index and prior months information, go to ChiefExecutive.web/class/CEO-Confidence-Index/