I like to consider stock accounting like managing your smartphone apps.

You retain observe of what’s put in (stock ranges), what’s used most frequently (stock motion), and what takes up probably the most area (worth). You create worth (gross sales) by clearing out area. To clear that area, you may make use of the First-In-First-Out (FIFO) methodology and delete older, unused apps first. Or you might use the Final-In-First-Out (LIFO) methodology and depart the outdated apps and filter out newer ones.

Whatever the chosen methodology, your finish objective is identical — monitoring and managing the objects you utilize to create worth. Stock accounting is the method of valuing and monitoring an organization’s stock property. It performs an important position in figuring out price of products offered (COGS), managing operations effectively, and producing correct monetary statements.

Overview of stock & stock accounting

What’s stock?

Stock is the gathering of products a enterprise holds and expects to promote to clients. Since companies use stock to satisfy buyer demand, managing stock helps forestall overstocking or working out of things. Since stock is anticipated to be offered inside a yr, it seems on the steadiness sheet beneath present property.

What’s stock accounting?

Stock accounting is the follow of recording, analyzing, and reporting an organization’s stock transactions and balances. This follow helps decide the price of gross sales and the worth of remaining stock.

Listed below are the important thing components of stock accounting:

- Monitoring: Monitoring stock ranges, motion, and utilization.

- Valuation strategies: Using totally different accounting strategies comparable to FIFO, LIFO, and Weighted Common.

Stock may be tracked utilizing a perpetual system or a periodic system. The perpetual system updates stock information in actual time with every sale or buy, offering steady accuracy. The periodic stock system updates information at set intervals, counting on bodily counts to find out stock ranges and value of products offered.

When you’re having hassle monitoring stock, I like to recommend Sq., as it’s an all-in-one gross sales system.

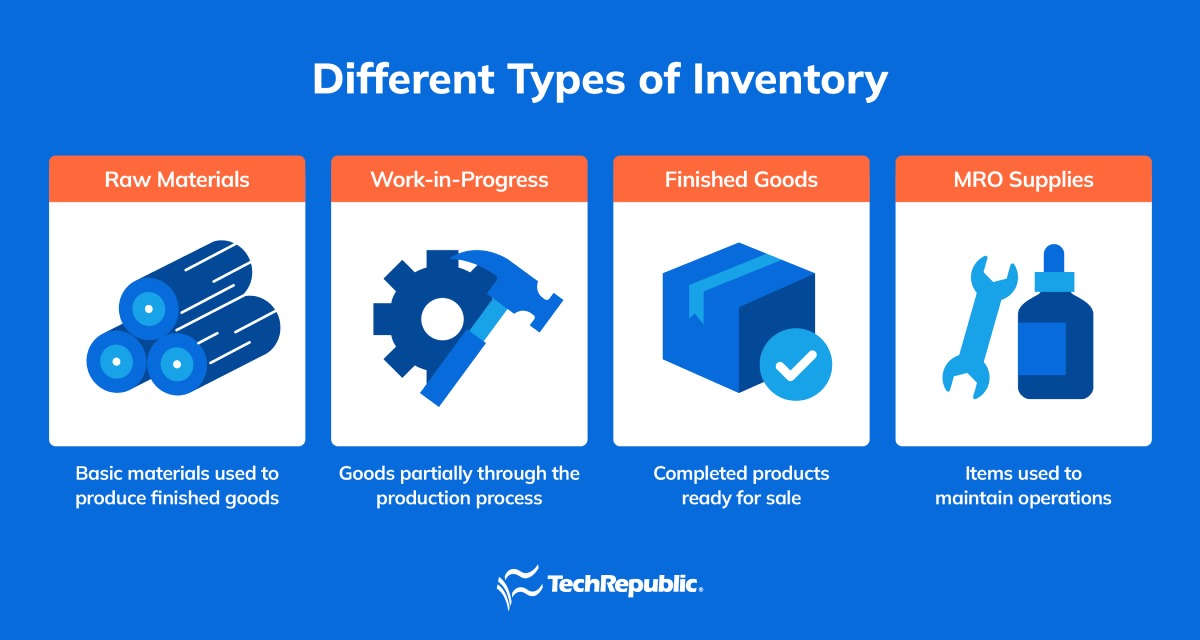

Kinds of Stock

Stock varieties are separated by stage of growth, starting from uncooked supplies to completed items. Here’s a fast abstract of stock in its totally different phases of growth.

| Uncooked Supplies | Fundamental inputs used to provide items |

| Work-In-Progress (WIP) | Semi-finished items, nonetheless in manufacturing |

| Completed Items | Accomplished merchandise prepared on the market |

| MRO Provides | Gadgets used to take care of operations (instruments, lubricants, and so forth.) |

Upkeep, restore, and operations (MRO) provides are supplies used to maintain an organization’s operations working easily. These things will not be instantly a part of the completed product. As a substitute, they’re tracked individually from manufacturing stock, as a consequence of their supporting position.

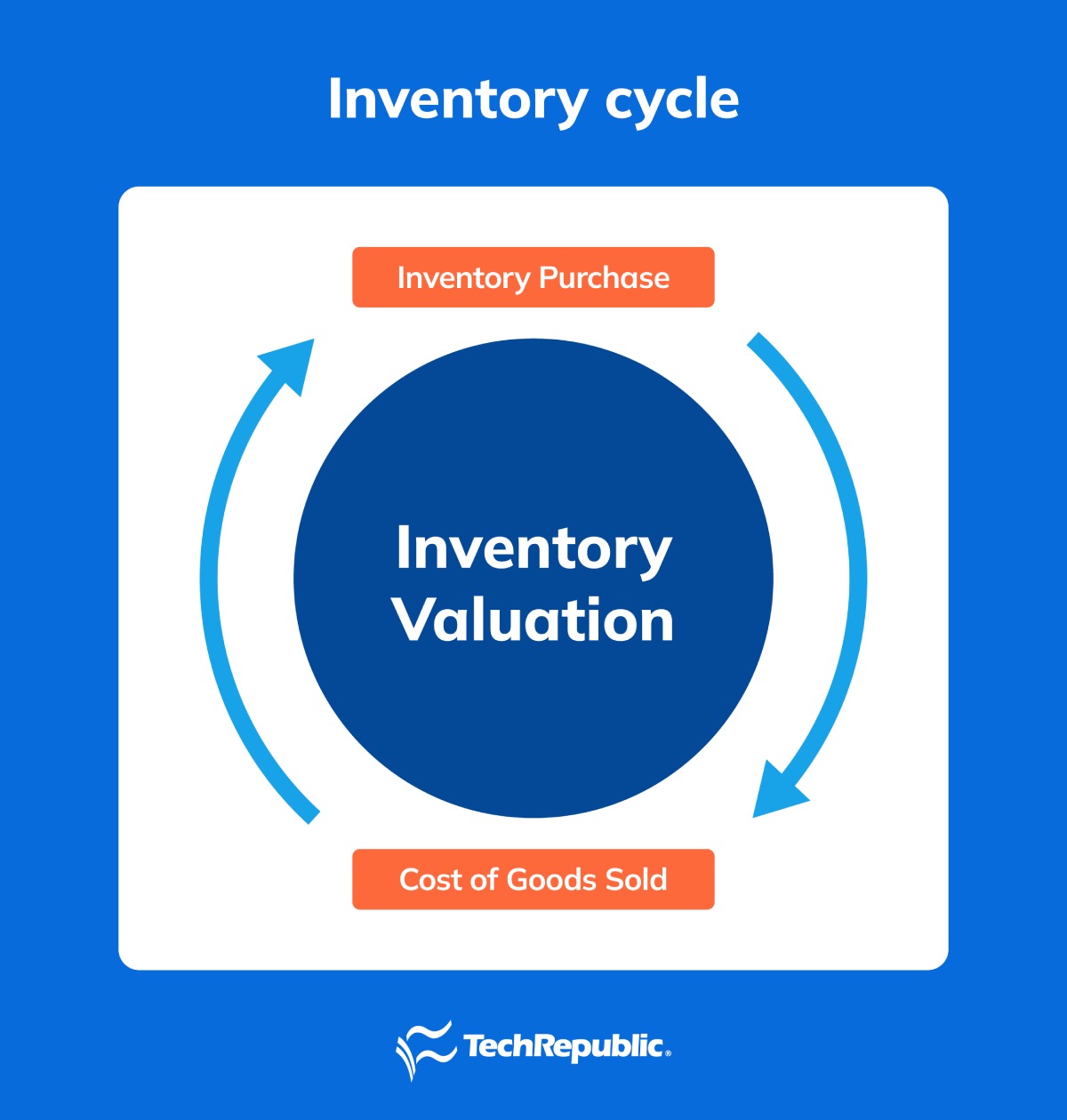

The stock accounting cycle

Stock accounting begins with the acquisition of things meant on the market. The cycle of a single stock merchandise ends with the sale, when the price of items offered is acknowledged. However all the gross sales cycle lives on, with extra stock being bought and offered. Stock valuation of unsold objects is ongoing all through the stock accounting cycle. Throughout this cycle, the next actions happen:

Stock buy: Gadgets recorded as an asset

Stock sale: COGS calculated

Stock valuation: Carried out periodically whereas the stock objects are held on the market

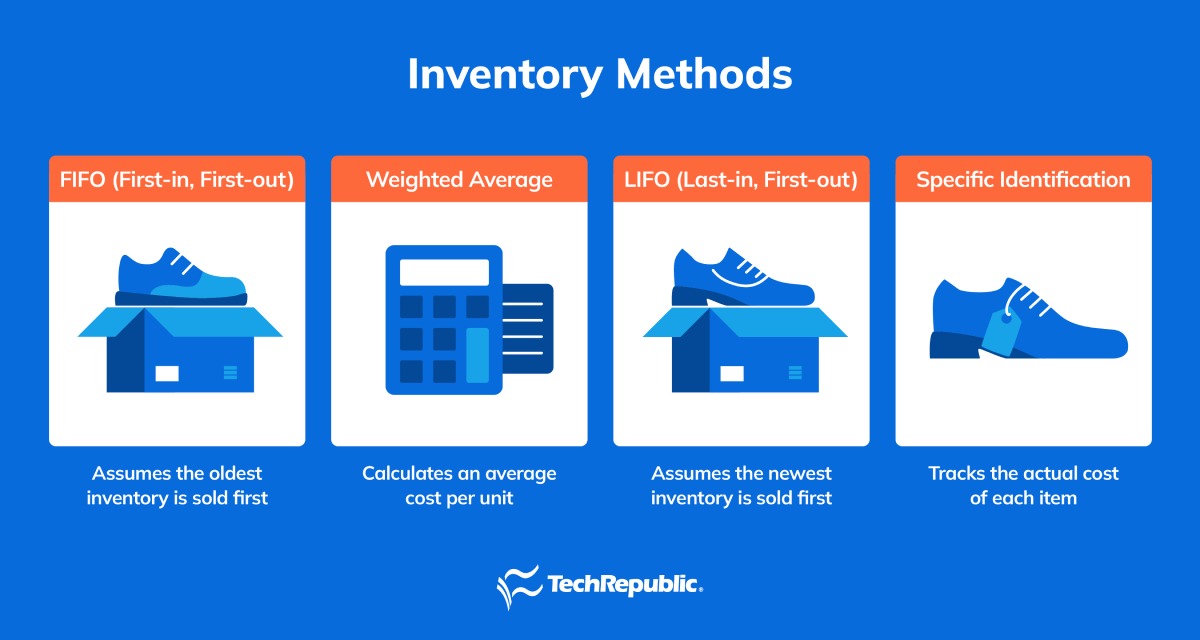

Stock accounting strategies

The most typical stock accounting strategies are FIFO, LIFO, Weighted Common Price, and Particular Identification. Every methodology impacts price of products offered and ending stock in a different way, which in flip impacts an organization’s monetary statements and tax liabilities.

| FIFO | Assumes oldest stock offered first | Throughout inflation, decrease COGS than LIFO |

| LIFO | Assumes latest stock offered first | Throughout inflation, larger COGS |

| Weighted Common Price | Averages price of all items | Smooths out worth fluctuations, reduces COGS volatility |

| Particular Identification | Tracks actual price of particular objects | displays precise historic price |

How stock accounting impacts monetary statements

Stock accounting impacts all three main monetary statements. On the steadiness sheet, stock is recorded as a present asset, instantly affecting an organization’s whole asset worth. On the revenue assertion, the COGS reduces gross revenue and finally internet revenue. On the money move assertion, stock reduces money move when objects are bought and will increase money move when objects are offered, which comprehensively impacts working capital.

Examples of stock accounting strategies

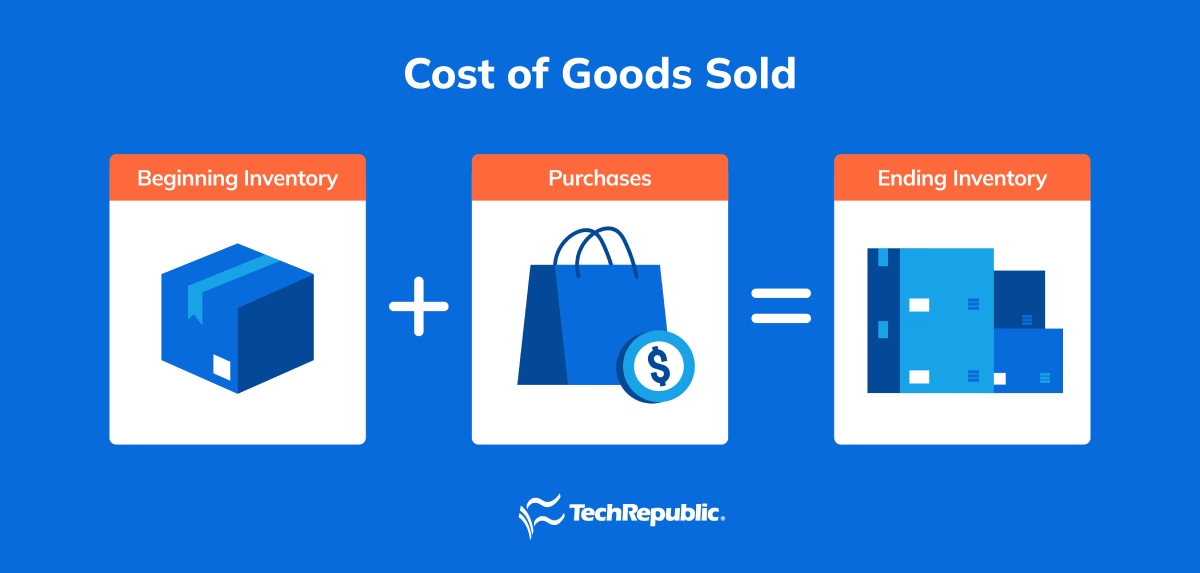

I’ll illustrate the influence of stock accounting strategies by utilizing a pattern shoe retailer to showcase the ends in a case-specific style. For every methodology, we’ll use the fundamental formulation for COGS. The examples under assume no starting stock.

Instance of stock accounting utilizing FIFO

| Items bought | Buy worth per unit | Complete buy worth | |

| January | 100 | $40 | $4,000 |

| February | 100 | $50 | $5,000 |

| March | 100 | $60 | $6,000 |

|

Complete |

300 | $15,000 | |

Stroll This Approach Sneakers offered 200 pairs of sneakers in March for $90 every, leading to income of $18,000. With FIFO, the oldest stock is offered first. Which means that the primary 100 pairs of sneakers offered price Stroll This Approach $4,000, and the second 100 pairs of sneakers offered price Stroll This Approach $5,000.

Starting Stock: 0

+ Purchases: $15,000

– Ending Stock: $6,000

COGS: $9,000

Through the use of this FIFO methodology of stock administration, the corporate offered the sneakers that had been bought first and sitting on the shelf the longest, versus promoting the sneakers most just lately obtained in March. Stroll This Approach’s internet revenue was additionally $9,000 ($18,000 – $9,000 COGS). Let’s evaluate that internet revenue to what could be obtained utilizing the LIFO methodology.

Instance of stock accounting utilizing LIFO

| Items bought | Buy worth per unit | Complete buy worth | |

| January | 100 | $40 | $4,000 |

| February | 100 | $50 | $5,000 |

| March | 100 | $60 | $6,000 |

|

Complete |

300 | $15,000 | |

Utilizing the identical truth sample as earlier than, Stroll This Approach Sneakers offered 200 pairs of sneakers in March for $90 every, leading to income of $18,000. With LIFO, the latest stock is offered first. Which means that the primary 100 pairs of sneakers offered price Stroll This Approach $6,000.

The second pair of 100 sneakers offered price Stroll This Approach $5,000. Through the use of this LIFO methodology of stock administration, the corporate offered the sneakers that had been obtained most just lately, versus promoting the sneakers that had been sitting on the shelf the longest.

Starting Stock: 0

+ Purchases: $15,000

– Ending Stock: $4,000

COGS: $11,000

Stroll This Approach’s internet revenue was $7,000 ($18,000 – $11,000 COGS).

Instance of stock accounting utilizing the Weighted Common methodology

| Items bought | Buy worth per unit | Complete buy worth | |

| January | 100 | $40 | $4,000 |

| February | 100 | $50 | $5,000 |

| March | 100 | $60 | $6,000 |

|

Complete |

300 | $15,000 | |

Utilizing the identical truth sample as earlier than, Stroll This Approach Sneakers offered 200 pairs of sneakers in March for $90 every, leading to income of $18,000.

Underneath the Weighted Common Price per unit, the price of sneakers offered is calculated as follows:

The 1st step: Calculate the fee per pair. $15,000 whole price ÷ 300 pairs of sneakers = price of $50 per pair

Step two: Apply the fee per pair to the variety of pairs offered. 200 pairs x $50 = $10,000

$18,000 gross income – $10,000 = $8,000 gross revenue

Instance of stock accounting utilizing the precise identification methodology

Let’s now think about that Stroll This Approach specializes within the sale of autographed basketball sneakers. Because of the distinctive nature of their product, they might solely have a handful of stock objects readily available, and every merchandise was bought at a novel worth.

| Items bought | Buy worth per unit | Complete buy worth | |

| January | 1 – signed by Michael Jordan | $4,000 | $4,000 |

| February | 1 – signed by Steph Curry | $5,000 | $5,000 |

| March | 1 – signed by Lebron James | $6,000 | $6,000 |

|

Complete |

3 | $15,000 | |

In March, Stroll This Approach offered the sneakers autographed by Michael Jordan and Lebron James for $7,000 and $11,000 respectively for a complete income of $18,000.

Whereas timing is a key issue with the LIFO and FIFO strategies, with the precise identification methodology, price is assigned per unit, regardless of when the merchandise was bought. Not like the Weighted Common methodology, price isn’t aligned with the price of some other stock objects.

The price for objects beneath the precise identification methodology is $10,000 ($4,000 + $6,000).

Starting Stock: 0

+ Purchases: $15,000

– Ending Stock: $5,000

COGS: $10,000

Underneath the precise identification methodology, Stroll This Approach’s internet revenue was $8,000 ($18,000 – $10,000 COGS)

Which stock methodology is finest?

For Stroll This Approach, the tax influence of stock strategies different. Assuming a 25% tax fee, LIFO turned out to be the winner of the 4 stock strategies by producing the bottom tax invoice of $1,750. Through the use of LIFO, the enterprise reported a decrease revenue of $7,000, however a tax financial savings of $500. This occurred as a result of newer, costlier stock was utilized in calculating COGS. This narrowed the hole between gross sales worth and value, which decreased revenue but additionally decreased the associated revenue tax.

- Earnings tax beneath FIFO methodology: 25% of $9,000 = $2,250

- Earnings tax beneath LIFO methodology: 25% of $7,000 = $1,750

- Earnings tax utilizing the Weighted Common: 25% of $8,000 = $2,000

- Earnings tax utilizing Particular Identification: 25% of $8,000 = $2,000

If Stroll This Approach’s goal is solely to scale back tax, LIFO could be the best way to go. If they’re extra involved with having a revenue and loss assertion that appeals to buyers, FIFO could be most well-liked because it produces the best internet revenue.

The most effective stock methodology for every enterprise is determined by the elements at play within the financial atmosphere. These elements embody business and product sort, in addition to worth volatility. Companies with perishable items typically use FIFO, whereas these managing rising prices could choose LIFO. Tax implications, money move objectives, and compliance necessities additionally play a task.

✅ Why use FIFO?

- Ensures older, typically lower-cost stock is used first, intently matching precise product move.

- As costs enhance over time, decrease price contributes to larger earnings, which can attraction to buyers or lenders.

- Stock valuation is easy and clear, making it simpler for monetary reporting and audits.

- Accepted beneath each GAAP and IFRS, making it ideally suited for worldwide companies.

✅ Why use LIFO?

- As costs enhance over time, income is probably not as excessive as different valuation strategies, however taxable revenue can be decrease; bettering short-term money move in inflationary environments.

- Higher displays present market prices in the price of items offered

- Generally utilized in industries with quickly growing stock prices, like manufacturing, retail, or commodities.

- Permitted beneath US GAAP, although not allowed beneath IFRS — finest for firms working primarily within the US.

✅ Why use Weighted Common?

- Smooths out worth fluctuations by averaging price.

- Less complicated monitoring — no have to match particular batches or observe oldest/newest stock.

- Generally utilized in companies promoting homogeneous objects (like sneakers, clothes, or groceries in bulk).

✅ Why use particular identification?

- Best when stock objects are distinctive or high-value, and value monitoring per unit is feasible.

- Ensures exact matching of price and income for every sale.

Greatest practices for stock accounting

Managing stock successfully is vital to correct monetary reporting and operational effectivity. The next finest practices may help guarantee dependable stock accounting:

- Select the suitable valuation methodology (FIFO, LIFO, or Weighted Common) to align with your online business objectives and business practices.

- Preserve correct information by monitoring stock ranges, purchases, gross sales, and changes — ideally in actual time with a perpetual system. Attempt one in all our greatest picks for the 5 Greatest Retail Accounting Software program.

- Confirm stock often by way of bodily or cycle counts, and separate worker duties to scale back errors and stop theft.

Backside line

Stock accounting is a important element of sound monetary administration and enterprise technique. The varied strategies of valuing and monitoring stock influence an organization’s monetary consequence. Finally, sturdy stock accounting practices enhance monetary accuracy, assist compliance, assist money move administration, and improve decision-making throughout enterprise capabilities.

Regularly requested questions (FAQs)

What are the 4 varieties of stock?

The 4 principal varieties of stock are uncooked supplies, work-in-progress (WIP), completed items, and upkeep, restore, and operations (MRO) provides.

Is stock accounting laborious?

Stock accounting may be advanced, particularly as companies develop or take care of fluctuating prices and enormous product varieties, however with an understanding of fundamental strategies, this essential job is manageable.

Why is stock accounting essential?

Stock accounting instantly impacts profitability and monetary reporting. It additionally impacts enterprise taxes and helps operational choices.

What are the stock accounting strategies?

Widespread stock accounting strategies embody FIFO, LIFO, Weighted Common Price, and Particular Identification.

Can a enterprise change its stock accounting methodology?

Sure, nevertheless it should disclose the change and justify it beneath accounting requirements.

How does stock have an effect on profitability?

COGS instantly impacts gross revenue; inaccurate valuation can distort profitability.

How typically ought to stock be counted?

Stock needs to be counted not less than yearly. Companies can also depend their stock on a extra common day by day, weekly, or month-to-month cycle.