For so long as accounting has existed, the precept of backup documentation has anchored monetary integrity. Each expenditure requires proof that proves a reliable buy occurred. In worker expense reporting, that proof has lengthy been the receipt.

For many years, receipts had been paper artifacts that auditors and approvers may examine and belief. Whilst receipts went digital, from scanned copies to smartphone images, one assumption remained: When you can see it, you’ll be able to imagine it.

That assumption now not holds true.

AI has damaged the chain of belief

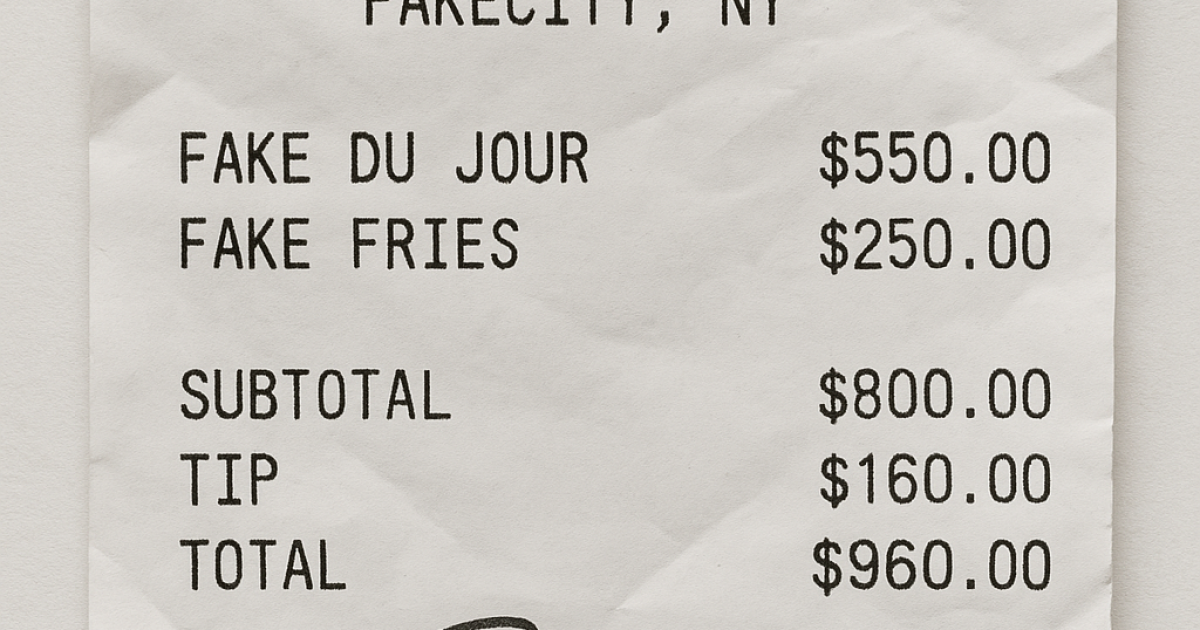

Generative AI has created a brand new class of fraud danger for accounting and finance groups. What as soon as required a colour printer and Photoshop can now be achieved with a easy textual content immediate. AI instruments can generate receipts which can be indistinguishable from genuine ones, full with correct logos, barcodes and subtotal math.

Some apps are purpose-built to generate authentic-appearing receipt photos. They exist for reliable causes akin to creating receipts for software program demonstration or testing OCR receipt seize. However the identical know-how makes it trivial for a fraudster to manufacture convincing receipts in seconds.

Throughout my analysis utilizing considered one of these apps, I created a fraudulent Residence Depot receipt in a couple of minutes. It was good with the proper structure, emblem and font, plausible line objects and a timestamp formatted precisely like an actual one. No human reviewer or OCR engine may inform the distinction.

The breakdown of image-based controls

This growth poses a elementary problem to longstanding inner controls. For many years, corporations have relied on receipt photos to validate purchases and fulfill auditors. Most accounting programs and practically all expense administration platforms nonetheless depend upon the receipt picture because the definitive file of proof.

But when photos can now not be trusted, what stays?

AI has successfully destroyed the evidentiary worth of receipt photos. A fraudulent picture can now cross each typical take a look at. It appears to be like genuine, the totals match and the metadata may be spoofed. Your entire management framework constructed round seeing and approving has been rendered unreliable.

Finance leaders now face a brand new actuality. Probably the most trusted type of buy proof can now not be verified.

The trail ahead is modernization, not worry.

What works at the moment

The easiest way to cut back the chance of AI-enabled receipt fraud is to restrict dependence on receipts altogether. That begins with company-paid playing cards.

When workers use company-paid bank cards, each buy flows via a managed channel. Every transaction contains verified information akin to service provider identify, buy date and quantity. This info can’t be altered by AI and supplies finance groups with a trusted file.

Organizations can additional restrict publicity by permitting out-of-pocket reimbursements just for small incidental purchases underneath $25, which minimizes fraud and simplifies reconciliation.

Digital playing cards construct on this basis. They’re a kind of company-paid card with stronger inner controls. Digital playing cards may be issued for particular functions akin to a venture, vendor or buy kind. They may also be configured with strict limits for service provider class, buy quantity and energetic date vary.

For instance, if a foreman for a building firm has a digital card tied to retailers that promote building supplies and instruments, the foreman cannot use this card to buy a tv at an electronics retailer.

Digital playing cards prolong the fraud safety of company-paid playing cards. They scale back misuse, enhance accountability and simplify reconciliation by imposing compliance robotically.

One other treatment out there at the moment

Trendy expense administration programs now use information analytics and AI to establish potential fraud. These programs analyze transactions to focus on purchases which can be most probably to be questionable. By specializing in the riskiest purchases, automated fraud detection can search for patterns that recommend potential misuse.

Whereas these programs can flag suspicious transactions, they can not at all times verify fraud. In lots of instances, the one approach to show whether or not a purchase order is reliable is by reviewing the receipt itself. This limitation factors on to the necessity for the subsequent stage of fraud prevention.

What comes subsequent

The final word resolution is verified digital receipts. These are receipts that come straight from the service provider, provider or point-of-sale system and are authenticated on the supply.

A main instance is Amazon Enterprise, which supplies digital receipts via integration. Every transaction may be pulled straight from Amazon’s API, making certain the main points itemized — SKUs, portions, costs and timestamps — are correct and untampered.

When information comes straight from the supply system of file, it carries digital belief. Fraudulent receipts, even AI-generated ones, develop into irrelevant as a result of they’re excluded from the method fully.

Verifiable buy information authenticated on the level of sale is the mannequin accounting groups ought to pursue.

A shift in verification philosophy

The implications of AI-generated receipts prolong past expense administration. They expose a broader vulnerability in accounting and audit processes that depend on static artifacts quite than verified digital information.

Within the coming years, we’ll see a shift from doc validation to information provenance, the flexibility to confirm the place information originated, when it was created, and by whom.

Finally, applied sciences akin to blockchain could underpin common transaction verification, permitting suppliers and POS programs to write down immutable buy data on to public ledgers.

For now, the hot button is to acknowledge that fraud prevention within the AI period is a layered protection constructed on management, traceability and supply authenticity and never on human evaluation of photos that may be faked.

The trail ahead

AI-generated receipts symbolize a brand new form of problem for accounting and finance groups. The problem will not be outdated programs or careless workers. The problem is {that a} new menace has emerged sooner than the know-how to defend in opposition to it.

As historical past reveals, innovation usually outpaces management. Fraud detection, coverage design and inner controls at the moment are catching as much as a world the place photos may be fabricated with good realism. The programs we’ve at the moment aren’t out of date. They’re merely working in a time when the subsequent technology of verification know-how has not but arrived.

Till verified digital receipts develop into widespread, organizations can strengthen their defenses by utilizing company-paid playing cards, issuing scenario-based digital playing cards and making use of AI-driven fraud detection. These measures create a layered protection that makes fraudulent purchases more durable to execute and simpler to detect.

The way forward for expense verification lies in information that’s digitally verified on the supply. Till that future turns into actuality, the aim for finance leaders is to modernize rigorously, layer intelligently and acknowledge that integrity relies upon not on photos however on info that may be trusted.