Spotify’s inventory has been unstable through the years, however its enterprise has been pretty regular. The Day by day Breakdown dives into the main points.

Earlier than we dive in, let’s be sure you’re set to obtain The Day by day Breakdown every morning. To maintain getting our each day insights, all you must do is log in to your eToro account.

Deep Dive

It’s that point of yr when Spotify provides us our year-end wrap — so we’re doing one for Spotify itself. As most readers know, Spotify supplies audio streaming providers worldwide by way of its Premium and Advert-Supported segments. The corporate, based in 2006 and headquartered in Luxembourg, has had a outstanding run as a public enterprise.

After greater than doubling from its 2018 opening worth to its 2021 excessive, shares collapsed within the subsequent bear market, falling greater than 80% — 🫣. However the rebound was much more dramatic: the inventory rallied over 1,000% from these lows, ultimately reaching an all-time excessive of $785 in June 2025.

The Enterprise

Because the chart above exhibits, premium customers, month-to-month lively customers, and income have continued to climb steadily through the years. Even throughout Spotify’s brutal 2021–22 inventory decline, the underlying enterprise saved increasing. Nevertheless, Spotify struggled with profitability for a lot of its historical past — from 2015 by way of 2023, it recorded just one yr of constructive working earnings.

That modified in 2024, when working revenue surged, and it has grown even additional in 2025. This shift to sustained profitability is a serious motive the inventory has seen such a strong rebound from its lows.

Future Progress Projections

After we look towards the longer term, analysts stay optimistic about Spotify’s underlying development potential. Discover how earnings development is much outpacing income development, which is an efficient signal for the corporate’s margins. In line with Bloomberg, analysts venture the next:

- Earnings Progress: 32.4% in 2025, 67.5% in 2026, and 27.7% in 2027

- Income Progress: 9.7% in 2025, 14.6% in 2026, and 13.9% in 2027

Analysts presently have a consensus worth goal of ~$773.50 on Spotify inventory, implying greater than 37% upside to at present’s inventory worth.

Need to obtain these insights straight to your inbox?

Join right here

Diving Deeper

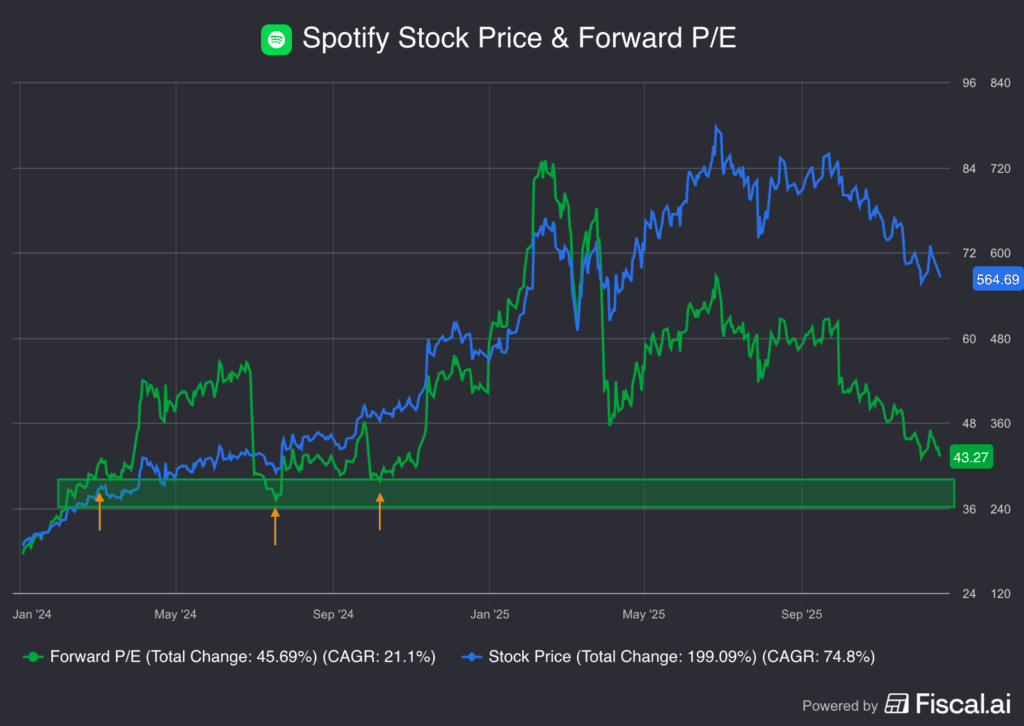

Now that shares have rallied greater than 1,000% from their latest lows, Spotify’s valuation is beneath comprehensible pressure. Nevertheless, the inventory’s ~28% decline from its summer time highs has helped ease that strain. Earlier this yr, Spotify traded at greater than 80x ahead earnings, and even at its summer time peak — when shares hit file highs — the a number of was nonetheless practically 70x.

Now buying and selling round 43x ahead earnings, the inventory sits simply above the zone the place it has lately discovered valuation assist — roughly 40x. Whereas that is nonetheless costly by many buyers’ requirements, the a number of has compressed considerably. In reality, valuation has fallen by nearly 50%, although the inventory itself has corrected solely about half that quantity. That tells us profitability is transferring in the fitting course.

Dangers

Spotify competes in a troublesome panorama, going up towards giants like Apple, Amazon, and Alphabet’s YouTube. Aggressive strain is a continuing danger — and so is valuation. If development slows or expectations reset decrease, the inventory might face extra draw back. Buyers can also determine {that a} decrease a number of is warranted no matter aggressive efficiency. Lastly, Spotify has proven a bent to say no extra sharply than the broader market throughout pullbacks, that means any notable S&P 500 correction might hit SPOT disproportionately laborious.

The Backside Line

Spotify has been a standout performer in recent times. For that to proceed, the corporate should uphold its robust development trajectory and maintain boosting earnings. After the latest dip, some buyers will nonetheless view the inventory as too costly, whereas others may even see the valuation reset as a recent alternative.

Disclaimer:

Please notice that resulting from market volatility, a few of the costs might have already been reached and situations performed out.