The Each day Breakdown takes a deep dive on PayPal, which simply bought off after reporting earnings. Is Wall Avenue proper or flawed on this one?

Earlier than we dive in, let’s be sure you’re set to obtain The Each day Breakdown every morning. To maintain getting our every day insights, all that you must do is log in to your eToro account.

Deep Dive

Within the earlier bull market, PayPal was seen as a high-quality development firm. However after a questionable acquisition technique and a painful bear market, the inventory has struggled to mount a significant rebound. Whereas shares are up practically 40% from their 2023 lows, PYPL inventory stays greater than 75% beneath its 2021 document excessive.

PayPal operates a worldwide funds platform that permits digital transactions for customers and retailers. Its manufacturers embody PayPal, Venmo, and Honey, amongst others — serving a variety of use circumstances from peer-to-peer transfers to checkout, lending, and rewards.

Turnaround Takes Form

Alex Chriss took over as CEO in September 2023, and the inventory bottomed a couple of month later. Since then, he has steadily labored to show the corporate round. Whereas the inventory fell greater than 11% following final week’s earnings report, it was nonetheless a strong quarter.

PayPal beat each earnings and income expectations, raised its full-year EPS outlook, and reaffirmed plans for $6 billion in share buybacks this yr — practically 10% of its market cap at present costs. Venmo additionally stood out, with 20% income development, far outpacing the corporate’s general gross sales development of 8.2%.

Trying on the longer-term image, analysts anticipate adjusted earnings to develop round 10% to 12% yearly by fiscal 2028, with income rising at a mid-single-digit tempo. As earnings development outpaces income, PayPal’s buyback can provide the underside line a lift and working margins — that are at a document excessive for the corporate — can proceed to increase.

Need to obtain these insights straight to your inbox?

Join right here

Diving Deeper — PYPL Valuation

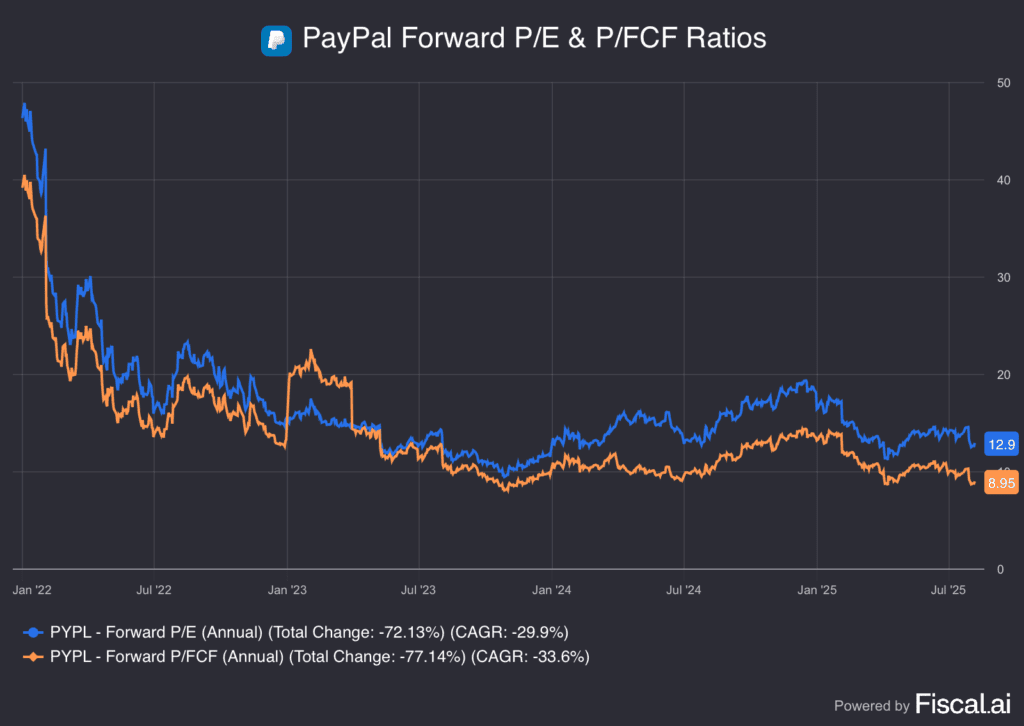

As Warren Buffett as soon as mentioned, “Value is what you pay, worth is what you get.” Whether or not it’s a development inventory, a turnaround story, or a blue-chip stalwart, valuation performs a vital function in figuring out whether or not buyers are getting a great deal. Primarily based on historic valuation metrics — corresponding to ahead price-to-earnings and price-to-free-cash-flow — PayPal inventory seems comparatively low cost.

Dangers

It’s simple to see double-digit earnings development forecasts and what seems to be a horny valuation and suppose, “This inventory is a no brainer!” Nevertheless it’s essential to do not forget that PayPal has had a depressed valuation for a number of years now. Whereas the enterprise is in higher form than it was two years in the past, that doesn’t assure the inventory shall be rewarded with a better a number of.

Additionally, look no additional than 2025 for a reminder that PYPL will not be a flight-to-safety worth inventory. Shares fell from the $90s to the $50s in just some months. Whereas that interval was marked by heightened volatility, it’s a helpful reminder: if the broader financial system weakens, buyers could as soon as once more flip away from this title.

If you wish to improve your investing information this summer time, make certain to affix our eToro Academy Study & Earn Problem, the place you’ll be able to take programs, go quizzes, and earn as much as $20 in rewards. Phrases and situations apply.

What Wall Avenue’s Watching

AAPL

Apple unveiled a brand new $100 billion funding to increase US manufacturing and analysis — a transfer that might protect it from President Trump’s proposed tariff on chip imports. The plan consists of strengthening chip provide chain partnerships and ramping up home iPhone part manufacturing — a part of Apple’s broader push to localize operations amid mounting commerce strain from the Trump administration. Analysts have a median worth goal of $134 for AAPL inventory.

BTC

Bitcoin, Ethereum, Ripple, and different cryptocurrencies are leaping this morning on information that President Trump will signal an government order aimed toward increasing the obtainable funding merchandise in US retirement accounts. It would reportedly embody cryptocurrencies, actual property, and personal fairness. Try the chart for Bitcoin.

Disclaimer:

Please word that because of market volatility, a number of the costs could have already been reached and situations performed out.