UnitedHealth and Amedisys are lastly on the identical web page as federal regulators.

The businesses have been attempting to merge since January 2023, although the Division of Justice held up the deal, arguing it will obliterate competitors for dwelling well being and hospice companies in sure U.S. markets. However underneath a brand new settlement between UnitedHealth, Amedisys and regulators disclosed Thursday, the $3.3 billion deal is now on a glide path to closure, in accordance with consultants.

“Given the truth that United is probably going very keen to place this behind them, it’s greater than prone to progress ahead,” stated Joe Widmar, director of mergers and acquisitions at consultancy West Monroe.

The settlement nonetheless must be permitted by a decide after a public remark interval. That, and different regulatory necessities across the settlement, imply the deal doubtless gained’t shut till 2026 on the earliest.

However the decide’s assessment is “not often a software to show over a settlement,” stated Robin Crauthers, a associate with legislation agency McCarter & English specializing in antitrust issues. “I feel the settlement sticks and the events shut and all of us simply transfer on.”

Amedisys inventory rose over Thursday’s commerce after a DOJ press launch introduced the settlement, a “sturdy indication” that buyers additionally suppose the transaction is within the dwelling stretch, TD Cowen analyst Ryan Langston wrote in a observe.

The deal’s tentative greenlight from the U.S. authorities is a welcome flip of occasions for UnitedHealth. The healthcare behemoth’s inventory has plummeted this 12 months as the corporate struggles with unexpectedly excessive medical spending for its insurance coverage members, unfavorable coverage modifications from Washington and widespread public criticism over its enterprise practices.

Amedisys, one of many largest dwelling well being and hospice suppliers within the U.S., is simply going to be a modest contributor to UnitedHealth’s earnings, in accordance with analysts.

Nonetheless, reaching a settlement with the DOJ over the deal removes a key supply of regulatory uncertainty that’s dogged the corporate for greater than two years. For UnitedHealth, it in all probability couldn’t have come at a greater time.

“It’s not terribly shocking to see [a settlement] occur, particularly given the 12 months United has had. They’re in all probability in search of a bit of excellent information,” Widmar stated.

Settlement could not protect competitors

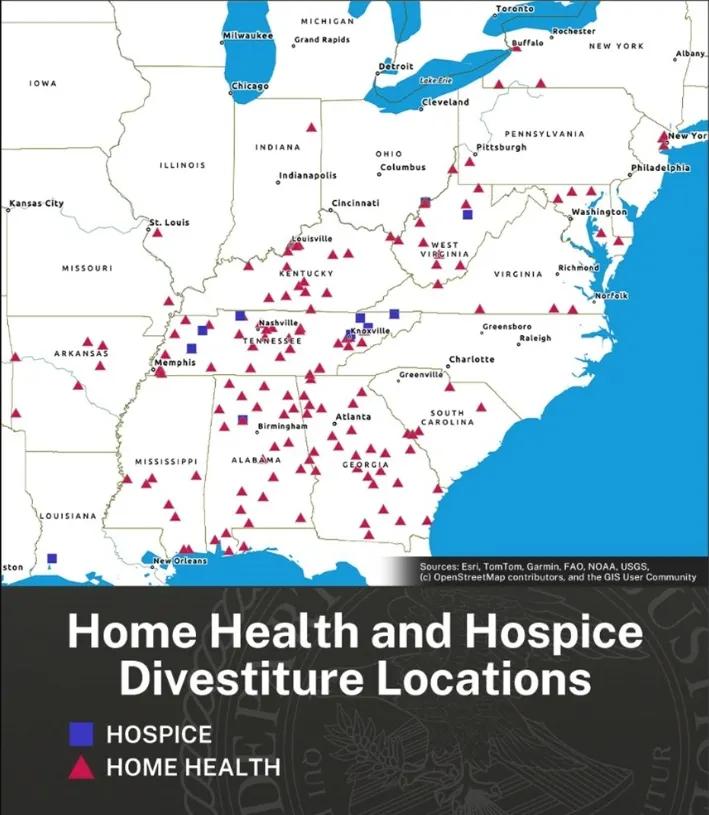

The settlement requires UnitedHealth and Amedisys to divest at the least 164 dwelling well being and hospice websites for the DOJ to approve the deal. The lion’s share of divested property present dwelling well being.

Two midsize dwelling well being and hospice operators, BrightSpring Well being Companies and Pennant Group, have agreed to accumulate the areas for an undisclosed quantity.

Neither firm responded to a request for extra info, although TD Cowen analysts peg BrightSpring’s funding within the vary of $200 million to $300 million and Pennant’s at round $100 million.

Different stipulations within the settlement power UnitedHealth and Amedisys to dump stakes in sure joint ventures, comply with monitoring of their divestiture plans and assist clinics acquired by Brilliant and Pennant compete in markets overlapping with UnitedHealth.

Regulators suppose this is sufficient to offset the deal’s anticompetitive results.

“This settlement protects high quality and value competitors for tons of of 1000’s of susceptible sufferers and wage competitors for 1000’s of nurses,” Abigail Slater, assistant lawyer basic within the DOJ’s antitrust division, stated in an announcement Thursday.

It’s the most important divestiture of outpatient healthcare companies to resolve a merger problem ever, in accordance with the DOJ.

Divested services are concentrated within the southeast, which is sensible given Optum’s heavy presence within the area following its acquisition of Amedisys’ competitor LHC Group in 2023, consultants stated.

The areas of dwelling well being and hospice companies that UnitedHealth and Amedisys have agreed to divest underneath the settlement.

However the settlement is weaker than anticipated primarily based on the wide-reaching aggressive issues the DOJ outlined in its November lawsuit looking for to dam the deal, in accordance with McCarter & English’s Crauthers.

The DOJ’s criticism — which was joined by 4 states — stated if the merger closed, UnitedHealth would management 30% or extra of the house well being or hospice market in eight states, whereas increasing for the primary time into an extra 5 states. UnitedHealth would gobble up the house well being market to a level that made the merger presumptively unlawful in tons of of native markets, regulators stated.

The DOJ’s criticism, which was issued by the Biden administration, outlined almost 800 dwelling well being and hospice markets that might see competitors reduce because of the Amedisys deal, in accordance with Crauthers.

Lots of these markets weren’t addressed in Thursday’s settlement, which comes from the extra business-friendly Trump administration, she stated.

“A settlement is meant to treatment the alleged substantial lessening of competitors. I’m unsure this settlement goes far sufficient — and that’s primarily based on the criticism,” Crauthers, who labored on the DOJ for six years, stated. “I don’t need to make it sound prefer it’s dangerous, however should you take the criticism at face worth the DOJ has taken lower than it meant.”

Previous divestiture plans proposed by UnitedHealth and Amedisys didn’t cross regulators’ muster. Final summer season, the businesses outlined plans to promote property to VCG Luna, a subsidiary of Texas dwelling well being and hospice firm VitalCaring Group — however that fell by way of after the DOJ stated VCG Luna was unreliable.

One other plan to promote property to BrightSpring and Pennant this spring was additionally initially rejected by the DOJ, in accordance with a CTFN report.

The DOJ didn’t reply to a request for touch upon how the brand new settlement differs from previous proposals.

In response to Widmar, the settlement seems prefer it ought to protect the aggressive established order within the markets that do embody the 164 divested areas — although it locations companies value virtually $530 million in income within the arms of BrightSpring and Pennant. Each are already “quite massive gamers,” he stated.

“I wouldn’t count on the variety of areas to essentially tip the scales,” Widmar stated. “The better concern, I’d think about, has been the truth that United as a vertically built-in well being insurer is making an attempt to deepen within the dwelling well being area.”

Vertical integration play

UnitedHealth is a diversified healthcare big, with the most important personal insurer within the nation, a serious doctor community and different companies that collectively exceed $400 billion in annual income.

Additional build up care supply — together with by buying gamers within the extremely fragmented dwelling well being market — is a key prong of UnitedHealth’s technique. The corporate says that buying Amedisys will assist it serve prospects on the lowest price and most handy web site of care, leading to higher outcomes.

“On common, sufferers who obtain dwelling well being care are readmitted to a hospital 36% lower than sufferers who don’t obtain dwelling well being care,” in accordance with an internet site hosted by UnitedHealth’s well being companies division Optum.

Offering such care may additionally show profitable because the U.S. inhabitants ages, which ought to improve demand for home-based care fashions.

Including extra dwelling well being capabilities can also be helpful for the way these property work together with UnitedHealth’s medical health insurance enterprise, UnitedHealthcare.

By nudging its members in the direction of in-house and low-cost settings, UnitedHealth can curb well being advantages spending whereas reimbursing its supplier subsidiaries for offering that care — basically paying itself for the service.

That overlap has turn out to be a font of income for the corporate. UnitedHealth’s intercompany eliminations — basically, how a lot income UnitedHealth pays its subsidiaries for offering companies to its personal insurance coverage members — reached $150.9 million in 2024, up 11% 12 months over 12 months. (This technique additionally lets UnitedHealth sidestep revenue caps in its insurance coverage division — its supplier companies haven’t any such restriction.)

As well as, dwelling well being property enable UnitedHealthcare to peek into beneficiaries’ houses and communities, giving it a clearer image of how they reside, eat and get round outdoors of the physician’s workplace. That info interprets right into a better consciousness of members’ wants, which UnitedHealthcare can use to forestall adverse downstream well being outcomes by investing in focused preventive care.

It additionally permits UnitedHealthcare to gather extra prognosis codes. Such codes are inherently helpful within the Medicare Benefit program, through which insurers’ reimbursement from the federal government is adjusted primarily based on the well being wants of seniors of their plans.

That incentivizes insurers to gather and report as many codes as doable, even when which may exaggerate how sick their members truly are.

UnitedHealthcare generated $14 billion in MA overpayments by way of this observe, known as upcoding, in 2021, in accordance with a research printed this 12 months. That was by far the most important quantity of any payer within the privatized Medicare program.

Dwelling well being is a serious driver of upcoding. The well being threat assessments and chart critiques that insurers present in members’ houses contribute to 7% greater threat scores on common, in accordance with a research printed final 12 months in Well being Affairs.

In February, the Senate Judiciary Committee requested UnitedHealthcare for extra details about its personal at-home well being threat evaluation program after the HHS Workplace of the Inspector Normal discovered the payer was raking in more cash from the federal government for diagnoses solely made throughout the critiques than another MA insurer.

UnitedHealth, which denies allegations of inappropriate coding, stated in June that it supported better federal oversight of at-home well being threat assessments. The Division of Justice is at the moment investigating UnitedHealth over its Medicare billing practices.

In an announcement, a UnitedHealth spokesperson stated the corporate would proceed to make enhancements within the dwelling well being and hospice care area, calling it a “important a part of our value-based care strategy.”

“We stay dedicated to delivering high-quality, compassionate care to the individuals and households who depend on us,” the spokesperson stated over electronic mail. “We’re happy to have reached a decision and are grateful for the Division of Justice’s cooperation.”