Regardless of widespread optimism for financial progress initially of 2025, new information reveals simply how a lot the intense volatility that has been plaguing enterprise lately has impacted CEO compensation.

In response to the just-released 2025–26 CEO & Senior Govt Compensation Report for Non-public U.S. Firms, the median CEO bonus payout for 2025 is predicted to be simply 25 p.c of base wage, considerably down from the 33 p.c achieved in 2021 and even under the pre-pandemic norm of 28–30 p.c.

The extent of volatility—financial, geopolitical and in any other case—that the enterprise surroundings has skilled for the reason that pandemic, and its affect on company aim setting, has performed a crucial half on this incapability for bonus pay to recuperate.

Compounding the impact is the truth that whereas base salaries at personal corporations have elevated over time, which might have helped help a decrease bonus-as-a-percentage-of base bonus, they’ve completed so at a a lot slower tempo than inflation.

“The median CEO bonus expectation noticed no change between the years of 2021 and 2024, hovering at $100,000,” stated Isabella Mourgelas, Chief Govt Group’s lead analysis analyst who has been producing the report for the previous 5 years. “In flip, bonus pay has turn out to be a smaller piece of the overall compensation package deal, and information from 2025 exhibits that development persevering with, with the median CEO bonus expectation falling to $80,000.”

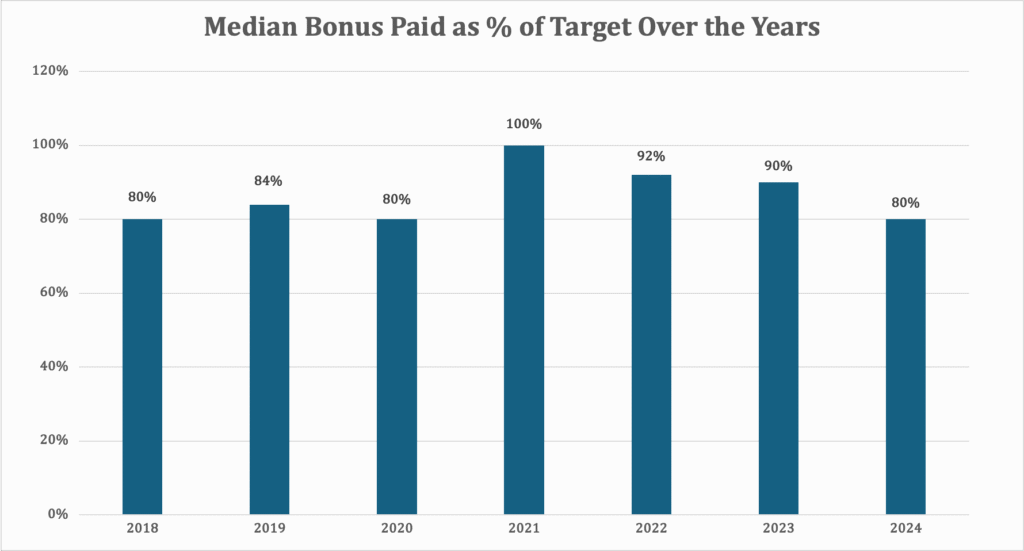

What’s extra, corporations hardly ever pay out the total goal bonus—not less than to these within the CEO seat. Certainly, information from the report exhibits that from 2018 to 2020, the median CEO bonus really paid out to the CEO represented 80 to 85 p.c of the unique goal. The pandemic yr of 2021 marked a notable exception, with the median CEO bonus payout reaching 100% of the goal, possible reflecting efforts to make executives entire once more after 2020 cuts. However that quantity was an outlier, and it has been declining again to pre-pandemic ranges since then.

The mixture of the decrease goal as a share of base wage, near-stagnant base salaries and the truth that the precise bonus payout is barely a fraction of that focus on explains why CEO bonus pay has been on a decline. It isn’t clear whether or not that’s as a result of a better share of CEOs haven’t met their performance-based targets or as a result of extra corporations have been setting their income and revenue targets too excessive lately with the mistaken hope of a robust bounce again to progress. However Eric Gonzaga, a Grant Thornton principal and apply chief specializing in government compensation methods, says volatility performs a giant position in all of this and he doesn’t see a lot of that altering in 2026—or at any time sooner or later.

The problem, he says, is that the kind of volatility we’ve been experiencing isn’t transient and using bonuses tied to firm monetary efficiency in government compensation isn’t prone to alleviate. “It’s tough for organizations proper now to choose aside [all that’s happening.] … Annual incentive alternatives are staying the identical, however boards are being very diligent about setting the best metrics, and that’s not simple proper now as a result of volatility makes it tough to foretell what a superb aim needs to be,” he says.

Mourgelas agrees: “Information from our CEO Confidence Index exhibits uncertainty is a essential driver of CEO sentiment concerning the present and future enterprise surroundings month after month. With that uncertainty comes transferring targets which can be usually reevaluated mid-year, making any long-term forecasting a problem—and that’s mirrored within the information for CEO bonus pay.”

Nonetheless, in line with the report, there may be hope.

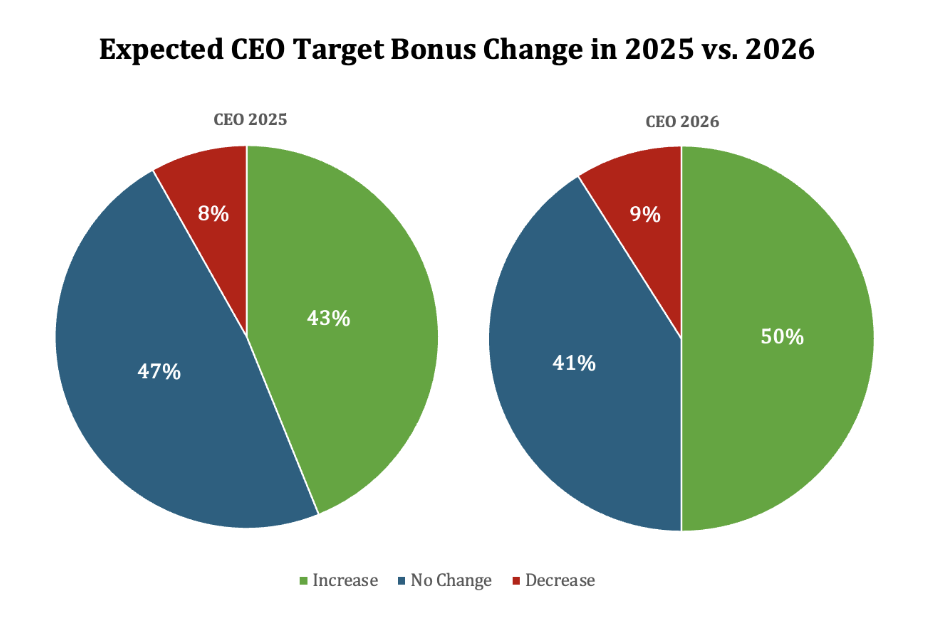

Precisely half (50 p.c) of the businesses surveyed stated they’re planning to extend their CEO’s bonus pay goal for 2026, whereas 41 p.c count on to take care of present ranges for not less than one other yr—a modest enchancment in comparison with 2025, when simply 43 p.c of corporations began the yr anticipating increased CEO bonus payouts.

THE SIZE FACTOR

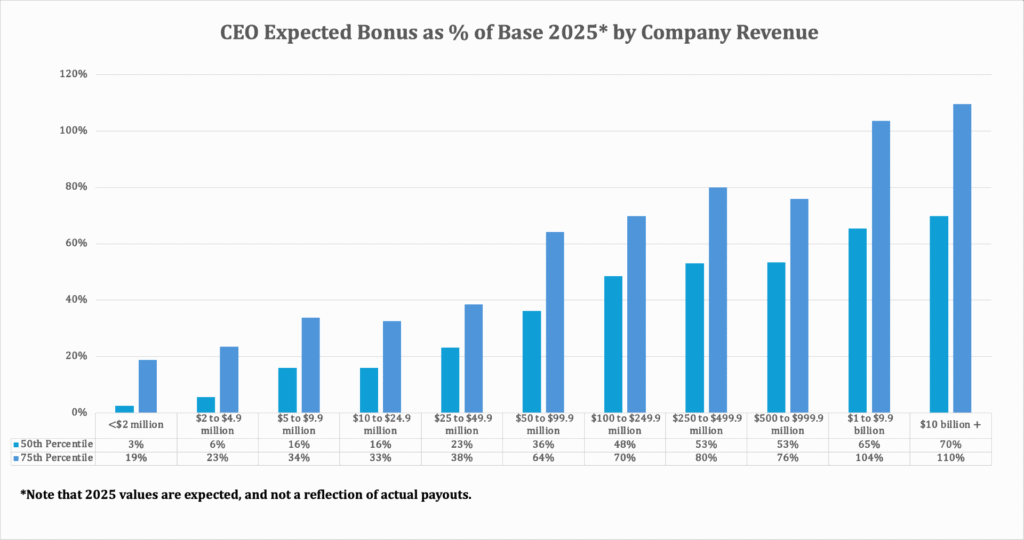

The report analyzes the pay packages of CEOs and senior executives throughout a number of dimensions, considered one of them being firm dimension (by annual income), and in line with that information, there’s a clear correlation between organizational scale and bonus compensation technique: The bigger the corporate, the higher the bonus as a share of the bottom wage.

At corporations with revenues underneath $100 million, the median CEO bonus fails to prime 40 p.c of base wage. In the meantime, CEOs at corporations with revenues of $1 billion or extra sometimes obtain bonuses exceeding 60 p.c of their base wage.

The sustained stagnation in CEO bonus compensation raises necessary questions on expertise retention and motivation in an more and more aggressive government market. As corporations grapple with financial uncertainty, the standard steadiness between mounted and variable compensation seems to be shifting, probably affecting how organizations appeal to and retain prime management expertise.

Govt pay is shifting: bonuses are down for a lot of whereas base salaries inch up, and possession construction, business and dimension proceed to drive massive variations. The 2025–26 CEO & Senior Govt Compensation Report for Non-public U.S. Firms unpacks these tendencies throughout roles and industries, with detailed breakdowns and forward-looking insights to information your 2026 planning.

Order your copy and make knowledgeable, future-ready compensation selections at chiefexecutive.web/compensationreport/order/.